Yuan is not manipulated: economist

Fred Bergsten of Peterson Institute says fact that intervention not over 2% of GDP is one example

A top US economist has dismissed two US presidential candidates' accusations that China manipulates its currency.

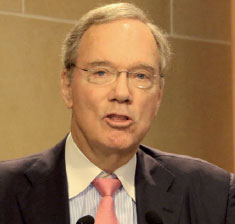

Fred Bergsten, a senior fellow and director emeritus of the Peterson Institute for International Economics, was the champion years ago talking and writing about the gross undervaluation of Chinese currency and currency manipulation in China.

But he told a seminar on Wednesday that "there is no Chinese currency manipulation."

"Indeed, if there is any manipulation, it is what I will call positive manipulation," he told a forum on the Chinese economy at the Peterson Institute.

Bergsten explained that for the last couple of years, China has not intervened to limit the appreciation of its currency, known as renminbi (RMB) or yuan, as it did in some earlier years. Instead, China sold a half trillion dollars of its foreign currency reserves to keep its currency from weakening further.

He said Republican presidential candidate Donald Trump does not have much basis for labeling China a currency manipulator and raising the issue again.

Trump has called China "the single greatest currency manipulator that's ever been on this planet" and he accused China of devaluing its currency in his opening remarks during the first US presidential debate on Sept 26.

Trump is not alone. Democrat presidential nominee Hillary Clinton also vowed repeatedly to confront China on currency manipulation.

Bergsten said Trump is just taking the talking points from 2012 Republican presidential candidate Mitt Romney by swearing to label China a currency manipulator on his first day in office.

|

Fred Bergsten, director emeritus of the Peterson Institute for International Economics |

He expressed that President Barack Obama, Treasury Secretary Jack Lew and thoughtful members of Congress are aware of the facts.

"But there is still a lot of politics around this," he said, adding that Clinton and her people also know better about this.

Former US Treasury Secretary Larry Summers noted months ago that it was a mistake for the US to push for China's exchange-rate liberalization in the hope that the yuan appreciates while market forces are pushing down the currency.

A US Treasury report in April did not accuse China of currency manipulation.

Bergsten, who is serving his second term as a member of the President's Advisory Committee for Trade Policy and Negotiations, described the issue of currency manipulation as "in remission". He warned of any possibility of renewal by China or any other country.

He believes part of the reason for the concern among US lawmakers is that the problem has not been satisfactorily resolved for a long time.

Congress passed legislation on a new currency policy early this year. Under the law, a country will be designated a currency manipulator if it meets three criteria.

The criteria are: a large bilateral surplus with the US, a large global current account surplus and a persistent one-sided intervention in the currency markets.

Bergsten indicated that China may meet the first two criteria but it does not meet the third one of persistent one-sided intervention in the market exceeding 2 percent of the GDP.

"So the situation is now clear. China is now not manipulating," he said.

Bergsten indicated that this is why there is no US-China currency conflict at the moment, but if the problem comes back, the domestic pressure will rise.

"I think we have a clear path forward to avoid new US-China currency conflict. It's now in remission; let's keep it that way," he said.

chenweihua@chinadailyusa.com

(China Daily USA 10/06/2016 page2)