Trade deal's benefits are already flowing

By Zhong Nan (China Daily) Updated: 2016-05-26 16:07

|

|

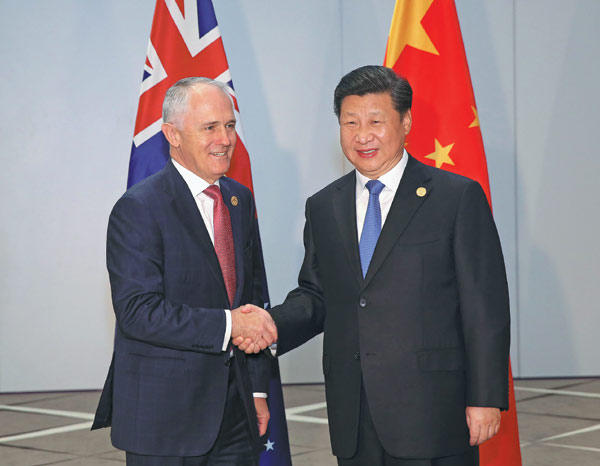

Chinese President Xi Jinping with Australian Prime Minister Malcolm Turnbull in Antalya, Turkey, on Nov 16. PANG XINGLEI / XINHUA |

Barely five months after the free trade agreement between Australia and China came into force it is paying dividends for Australian businesses, says the Minister for Trade and Investment, Steven Ciobo.

The government's decision to sign the deal had helped boost exports to China substantially, Mr Ciobo said earlier this month.

The reduction and in some cases abolition of tariffs on agricultural products had led to a big rise in exports to China, something he said was greatly benefiting Australian businesses and would continue to do so for years to come.

Among the best-performing items were wine, beef, seafood and vegetables.

"Between January and March 2016, Chinese imports of Australian bottled wine grew more than 60 percent compared with the same period 12 months previously, to reach $US160 million ($222 million), as tariffs were cut twice, from 14 percent to 8.4 percent.

"With tariffs cut, China's $9 million worth of imports of fresh Australian lobster between January and March were triple those of 12 months ago, and exceeded China's entire 2015 imports of Australian lobster. Milk powder and fresh cherry imports more than doubled."

Mr Ciobo's enthusiasm for the trade pact echoes that of the Prime Minister, Malcolm Turnbull, who led a 1,000-company delegation, Australia's largest ever to China, recently. He said he was honored to be the first Australian prime minister to visit China since the trade deal came into force.

Under the agreement more than 86 percent of Australian exports can enter China duty-free, with the proportion rising to 94 percent in 2019 and 96 percent in 2029.

Analysts say the trade pact will promote the two countries' trade ties as both shift into sustainable growth focusing on Asia's burgeoning consumer economy.

Wang Shouwen, China's vice-minister of commerce, said the China-Australia free trade agreement not only cemented China's competitive advantage for its traditionally strong industries, but also extended collaboration in areas such as infrastructure, energy and services.

Trade between the two countries was worth $114 billion last year. China's exports to Australia rose 3 percent to $40.34 billion thanks to Australia's rising demand from China's infrastructure, machinery manufacturing and garment sectors.

Australian agricultural goods trade with China including rice, wheat, wool and cotton have encouraged New Zealand to upgrade its free trade agreement with China, and sped up negotiations on other free trade deals and the Regional Comprehensive Economic Partnership, Mr Wang said.

Shanghai YTO Express (Logistics) Co, China's third-largest express delivery firm by cargo aircraft number, will introduce more than three wide-bodied air freighters into its fleet in 2018 to conduct international delivery operations including those between China and Australia.

Yu Weijiao, chairman of YTO Express, said that as Chinese consumers have switched from traditional staple foods to higher-protein foods such as beef, lamb and milk, the prices of these products will be attractive to China under the framework of the China-Australia free trade agreement.

China now imposes tariffs of between 12 percent and 25 percent on Australian beef, but these will be phased out within nine years under the pact. Tariffs on Australian wine will be dropped by 2018.

The agreement covers more than 10 areas, and includes a simplified review procedure for investments, most-favored-nation treatment, favorable market access rules and market transparency.

"These terms will help Chinese companies diversify their business categories and raise their incomes in the global market," Mr Yu said. "We will have fewer restrictions in tapping the Australian market, and Australia will find new opportunities for its economic growth in the coming decade in partnership with China."

Private Chinese investment under $US830,000 will not be subject to the approval of Australia's Foreign Investment Review Board. There is also an Investor State Dispute Settlement mechanism.

China is Australia's largest export market, with commodities, natural resources and agricultural products at the top of its export list. Australia is also China's fifth-largest trade partner, with machinery, telecommunications equipment, computer, furniture and garment products as its pillar items for shipment, according to Customs data.

Dereck Ji, senior partner of Roland Berger Strategy Consultants, said trade agreements such as those between Australia and China and South Korea and China can push large Chinese companies to upgrade their product content to design more items that are popular in these overseas markets.

However, he warned that "Chinese manufacturers can no longer rely on low-cost materials and cheap labor to compete with foreign rivals. An open market doesn't mean lower prices and low value-added products, but brands, technologies and strategic market approaches for Chinese companies".

Zhi Luxun, deputy director-general of the department of foreign trade at China's Ministry of Commerce, said China's fast-growing 4G telecom networks and the country's Made in China 2025 plan will lead to improvements in productivity and resource efficiency.

"The potential benefits are even greater if they are extended to all stages of the value chain: suppliers, manufacturers, and customers, as well as global markets."

Xinhua contributed to this story.