Chinese marketing giant moves into London

The Chinese independent digital marketing agency Hylink has started its expansion into Europe with the launch of a United Kingdom office in London's iconic skyscraper The Shard.

Hylink specializes in helping foreign brands enter the Chinese market and in supporting Chinese brands in reaching Western consumers. The agency started in 1994, when it focused mainly on traditional TV advertising. It expanded rapidly after it saw the online boom coming and switched to web-based marketing in 2002.

The agency employs 2,200 people in China and opened an office in the United States last year. Hylink's Western clients include Ikea, Shell, Estee Lauder, and General Mills. It also serves major Chinese enterprises, including Suning, Alibaba, JD, Tencent, and Baidu.

Humphrey Ho, managing director of Hylink Digital in the US, said the company hopes to assemble a UK team of 20 people by the end of the year, to be led by James Hebbert, the branch's general manager.

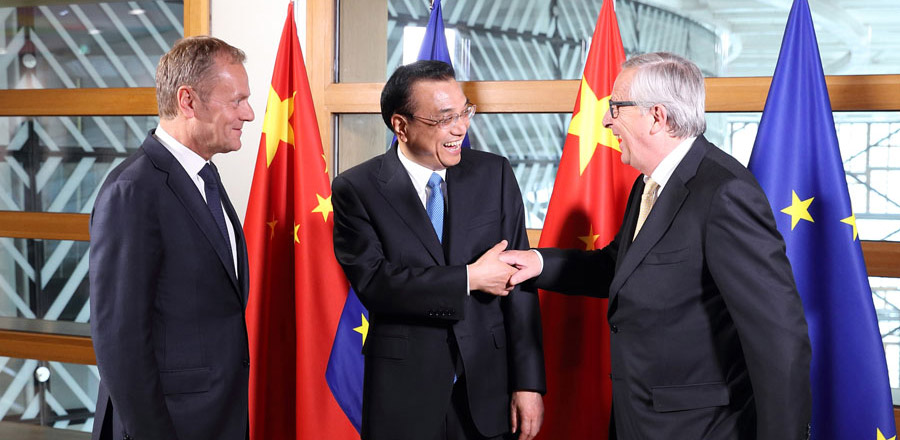

Ho said: "The UK is a very important market for both its breadth of client resources as well as its closeness to doing business in China. We are committed to increasing mutual marketing goals for British and Chinese businesses that are already in China and are coming to the UK."

He said the company plans to continue its expansion.

"The UK is also a window to continental Europe where our next global expansion opportunity exists," he said. "It's also the global home of some of our already existing clients, such as MG and Rover."

The Chinese market presents huge opportunities and challenges to foreign brands, Ho said. Several high-profile brands have either downsized or pulled out of China after struggling to crack the market. British online retail group Asos, German online food and drink service Delivery Hero, and New Zealand-based baby formula brand Karicare were among foreign brands that pulled out in 2016.

Ho said brands must overcome a range of challenges in China, including navigating a new consumer culture, operating in a different media landscape, and identifying appropriate distribution and logistics partners. Chinese brands experience similar growing pains when tackling Western markets, he added.

"With the development of both the Belt and Road Initiative as well as Chinese brands finding new markets globally, (Chinese companies) will need to understand local culture and customs," he said. "As the new player, they must pay respect to the dominant brands in their new homes, as these Chinese brands expect when foreign brands enter the Chinese market and are competing with them as the leaders of those categories."