Vandalism a bump in road for bike-sharing

By ANGUS MCNEICE | China Daily | Updated: 2018-04-17 07:58

Ofo and Mobike remain on course for UK expansion while smaller operators hit by thieves and vandals call for industry regulation

When a Chinese dockless bike-sharing scheme was launched by Mobike in the Northern English town of Stockport in March, residents took to social media to voice their approval.

"Really great to see Mobike launching in Stockport," a Twitter user wrote. "Hopefully, it will take off."

Days later, however, a second wave of commenters rose up, this time to lament the suspension of the scheme due to widespread reports of vandalism-"So sad that a few spoil this for the majority," one user said.

Beijing-based Mobike rolled out 200 of its silver and orange bikes on March 12 in Stockport, 8 kilometers southeast of Manchester, promising 800 more in the coming weeks. On March 24, though, Mobike suspended the service in order to "protect our bikes and our team".

The company, which has since resumed its service in the town, has not disclosed how many bikes were stolen or damaged, though there are anecdotal reports that more than a third of the fleet was vandalized in the first 10 days of operation.

It's been a year since Ofo-Mobike's biggest rival-brought the first dockless bike-sharing scheme to the UK from China, and the industry has developed rapidly, with several new operators rolling out in cities across Europe.

But the issue of vandalism is not confined to Stockport, and for some smaller companies it can be crippling.

In January, Hong Kong bike-sharing company GoBee pulled out of the Belgian city of Brussels, and Lille and Reims in France, because 80 to 90 percent of its fleet in those cities had been damaged or stolen. GoBee is continuing to supply a service in Paris, and the Italian cities of Florence, Turin and Rome, where only 1 to 6 percent of the fleet has suffered from vandalism.

"We must face up to the sad reality that a minority bent on destruction does not share our vision on mobility, and we can no longer support the financial and moral costs of the repairs," GoBee said in a statement.

But the world's largest bike-sharing operators Ofo and Mobike dismiss vandalism as a manageable growing pain.

"As with many new launches there can be teething problems, but we are working closely with the council, the police and local stakeholders to address any issues and make the scheme a success in Stockport," said Darryl Evans, Mobike's general manager.

When Mobike launched in Manchester last summer, the scheme lost 8 percent of its fleet to theft and damage. The company's UK manager, Steve Pyer, said once the novelty of the scheme has worn of, vandalism decreases sharply.

"About 80 bikes have been damaged in Manchester. Everywhere else is minimal, a couple of bikes here and there," Pyer said. "We haven't had a repeat of Manchester in Oxford or London. We've got about 1,200 bikes in Manchester and the level of vandalism has dropped off a cliff."

Joseph Seal-Driver, UK manager for Ofo, said that cases of vandalism are well publicized, but have had minimal impact on the company's operations in Britain.

"You get the first issue of a small but noticeable amount of vandalism-a bike in a river or something like that-and the press picks up on it," he said. "And then eventually, the bikes become part of everyday life, people start using them every day. Vandalism just peters out."

Dublin-based dockless operator Urbo, which operates in London and Ipswich, said that maintaining a dedicated on-the-ground team is key to controlling the threat of vandalism.

"Our level has been low-only about 5 percent of our fleet have been vandalized or stolen. Credit goes to our operations team," said Urbo co-founder Tom McGovern.

"It's a bit like the broken window effect-if one window in a house is broken, more will be broken soon. If you leave a vandalized bike laying around for a long period, you're increasing the chances of more of your fleet getting stolen."

Like Urbo, both Ofo and Mobike have teams that move bikes to high-use areas, perform general repairs, and respond to cases of vandalism.

The European Cyclists Federation estimates that these teams account for 30 percent of an operator's costs.

"The question many people ask is how does each city treat shared assets, what kind of a society is it? Can people share things? I'm not sure if that is a good question," Seal-Driver said. "It's actually often about the execution of the service-how it's managed, how robust the bikes are. And that's why we've done a good job in the UK."

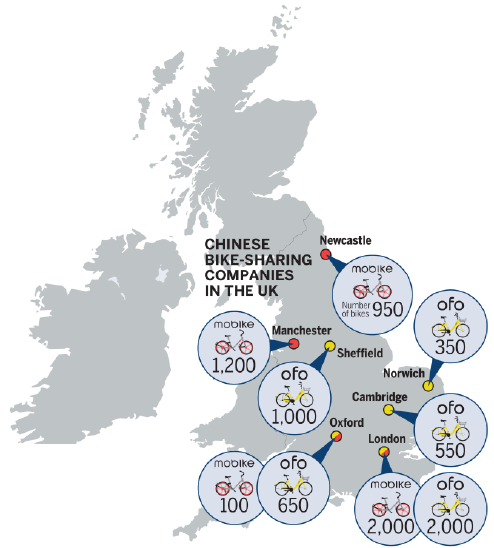

Since launching in Cambridge in April 2017, Ofo has spread to London, Norwich, Sheffield and Oxford, and will soon be available in Leeds.

The bike-sharing company has about 4,500 bikes on British roads-around the same as Mobike, which operates in Manchester, Newcastle, Oxford and London.

"We have 35,000 downloads of our app every month in the UK. We are very bullish about the future of this business," Seal-Driver said.

Both companies operate their fleets without docks, and users lock and unlock bikes using a mobile app.

For many Londoners who live on the outskirts of the city center, the scheme offers an alternative to London's docked bike-sharing system.

"I use both Ofo and Mobike, and the key reason is convenience," said Adam Silver, a bike-sharing user who lives in Southeast London.

"These bikes stretch far into my area and are incredibly easy to use. I go all over town with them, from an evening restaurant booking to a simple errand."

Silver said that he does have concerns over data privacy, as the apps record location information and access contacts.

"I always worry about data concerns, I do with every app but, for better or worse, those concerns are overridden by the convenience of the scheme," he said.

Both Ofo and Mobike say they only share GPS data with councils, and do so for free.

"The data is very valuable," said Pyer. "We don't keep anything about the person. It's all about cycling routes, cycling infrastructure, where the bikes are going. They can see exactly which roads they take, a really rich data set straight away."

For now, both companies say that data will remain with local authorities.

"We're not about to start advertising on bikes, we are not about to start monetizing the data," Pyer said.

As was the case in China when dockless bike-sharing first started, a number of smaller operators have begun to compete for riders across the UK.

Singapore-based operator oBike runs in Oxford, having withdrawn its bikes from London following an ill-fated launch last year when it did not inform councils of rollouts.

British company YoBike operates more than 300 dockless bikes in Bristol, while Dublin-headquartered Urbo runs 500 bikes across three London boroughs and 100 in Ipswich.

McGovern says Urbo's primary concern is not vandalism, but competition from operators with much larger financial clout. Both Urbo and Ofo compete for riders in the borough of Redbridge in East London.

"In Redbridge, we sat around the table with the council and Ofo to make sure we're on the same page," McGovern said. "We needed to ensure that rules were in place to ensure that predatory pricing doesn't occur."

In China, analysts have long warned that the bike-sharing sector is a bubble, with a surplus of operators backed by too much funding competing for too little profit.

Ofo recently raised $866 million in a financing round led by Alibaba Group, having already raised $700 million in 2017. Last year, Mobike raised $600 million in a funding round led by Tencent.

By comparison, Urbo is currently looking to raise 5 million euros ($6.2 million) to fund planned expansions in the UK and Ireland, and GoBee managed to raise $9 million in its last financing round.

Over the last year, four of China's 30-plus bike-sharing operators, including the third-largest, Bluegogo, have gone bust. Mobike and Ofo now control 90 percent of the market in China.

"Regulation is going to be key to ensuring healthy competition in this market," McGovern said. "We don't want to see any predatory pricing like we've seen in China, where some operators were giving free rides for as long as six months, meaning smaller, less-funded operators go out of business."

Dockless bike-sharing is not yet regulated by the UK government, though most operators including Ofo and Mobike have signed up to Bikeplus, an informal governing body for bike-sharing operators in Britain.

Bikeplus director Antonia Roberts estimates ride fares account for around one third of an operator's income.

"It's important that we find a way in order to collectively agree that we should allow businesses that aren't heavily financially backed to be sustainable, and not damaged by prolonged promotions or extremely low pricing and free offers," Roberts said.

Pyer said that Mobike welcomes regulation in the UK following the turbulent beginnings of the bike-sharing industry in Asia.

"With the benefit of hindsight, in China there should have been more regulation to start with," Pyer said.

"In the UK, you've seen images from China of massive bike mountains, and there was a bit of hysteria a year ago. But we've gone the other way-we've started with strict regulation, and everyone is now seeing the benefit."

Going forward, Mobike plans to expand to 15 cities in the UK by the end of the year, while Ofo wants to build its London fleet to 150,000.