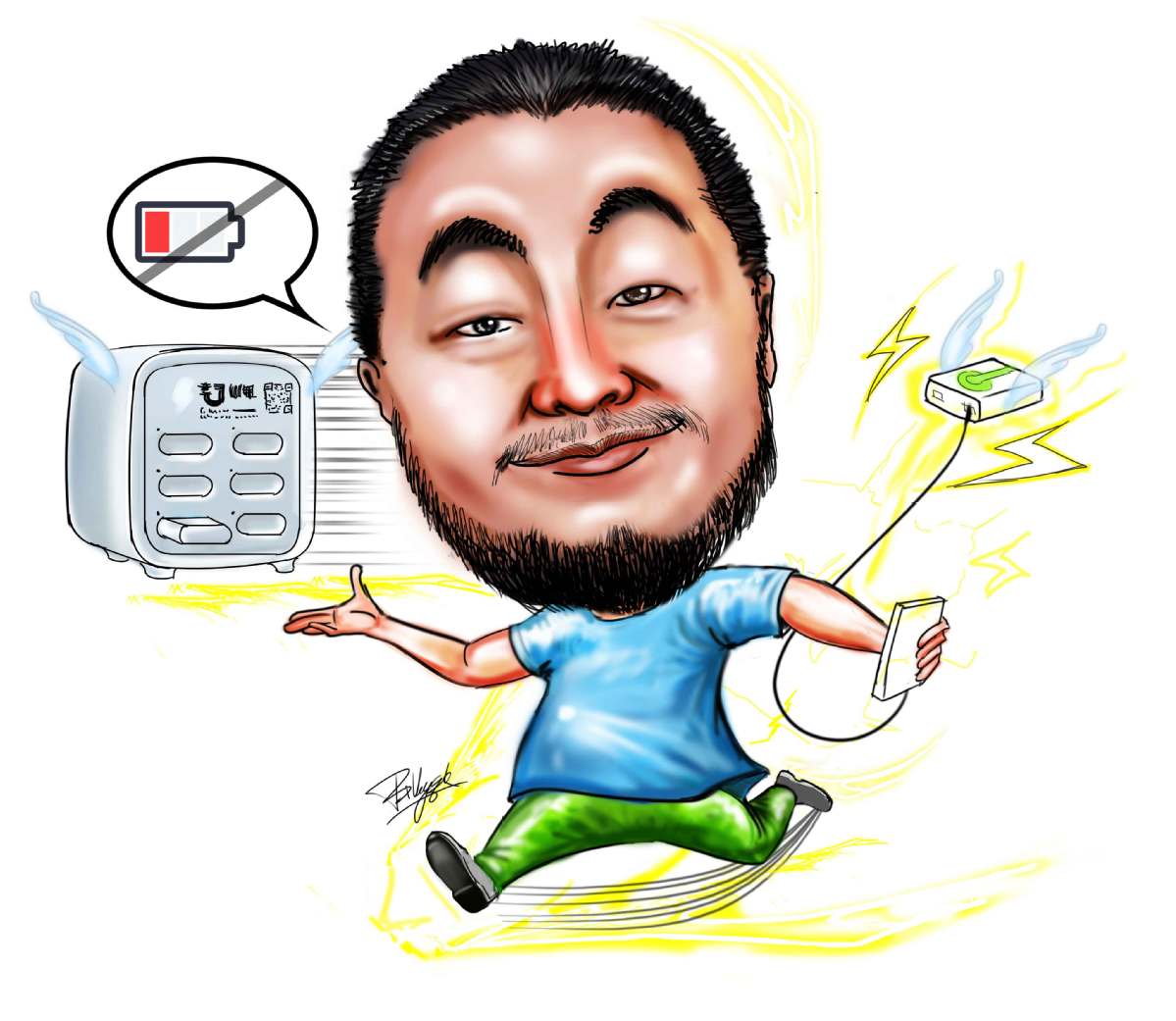

Shared power banks move quickly into black

By CHAI HUA in Shenzhen | China Daily USA | Updated: 2018-05-12 02:26

Editor's note: The shared economy has never ceased to evolve since taking the world by storm in the past few years. Shared power bank services have burst onto the scene on the Chinese mainland, sparking another round of fierce competition, with only the fittest being able to ride it out and survive.

The business model of the shared economy, which has taken the world by storm in the past few years, has inspired many entrepreneurs to apply it in various industries. But, the crucial question has been: Can it actually make money?

A Shenzhen-based startup that provides shared power bank services has replied in the affirmative, saying it has been raking in a profit in some cities on the mainland since last November.

Yuan Yuan, chief executive officer of Ankerbox, says their operations have paid off in some matured markets and the overall cash flow is positive. However, the company has yet to make a profit in cities where it has just started with new equipment being installed.

Ankerbox's business model is simple — it places a pack of power banks in cafes, restaurants and other public locations, where users can take one out after scanning a QR code and paying a rental fee of about one yuan for each hour. After charging, users could return the device to another Ankerbox collector anywhere.

The rental fee is the company's major source of income. A deposit of 99 yuan ($15.57) is also usually required, but service providers could not make use of that fund under national regulations.

For users, the first half hour is free of charge, which accounts for one third of their orders. But, Yuan says "it doesn't matter" because he believes they would eventually become paid members in future after having tried out the service.

According to Shanghai-based iResearch Consulting Group, the cost of one of Ankerbox's power banks is about 200 yuan, and the company would take about four-and-a-half months to break even.

In its early stages, Ankerbox was an internal project set up by power bank manufacturer Anker in 2015, and mainland e-retailer Jumei acquired a 60-percent stake in the enterprise for 300 million yuan in May last year. At that time, Yuan had left Alibaba Pictures Group to launch the new startup, giving up Alibaba shares worth tens of millions of yuan.

According to iResearch, the industry had reached a crescendo within a year. It said the market size of China's power bank sharing sector recorded almost 100 million yuan in 2017, and is projected to hit 330 million yuan in 2020. But, the growth rate would drop from 71.4 percent this year to 48.2 percent in 2019.

The competition is even fiercer than that in the country's once booming shared-bike industry. This had forced some players to pull down the shutters after less than six months, but about four operators had stood out, plowing themselves into the black by the end of last year.

Allen Zhu, managing director and partner of GSR Ventures, as well as one of the earliest investors in the power bank industry, told China Daily that the key to survival is to win as much market share as quickly as possible.

Yuan's experience in the field has come in handy, helping Ankerbox to ride out the brutal competition last year. Before joining the company, his job was to promote Alibaba Group's AliPay to offline shops and was subsequently appointed to expand the group's online ticket sales to theaters.

His goal now is to stir up a craze about what he has been promoting. "I used to watch 100 movies in a year when I was with Alibaba Pictures and now I borrow one charger every day," Yuan tells China Daily.

So far, his 1,000-strong team has covered more than 200 cities across the mainland, servicing some 60 million users — the largest recorded in the industry.

He expects the number of daily users to soar to three to five million by late this year — from about one million at present.

"Only until that time, it would be reasonable for us to cash out through other methods, such as working with e-commerce traders, advertisers and credit agencies."

At the same time, Ankerbox is eyeing the huge passenger flows at train stations and airports, such as working with Beijing Railway Station, Guangzhou's Baiyun International Airport and Wuhan's Tianhe International Airport, in a bid to win over new customers.

The company is also inserting new functions into their power bank distributing and collection boxes, such as adding screens to show flight and ticket information at airports.

Another approach to diversify income sources is to venture into the global market. Yuan says users in Southeast Asia will enjoy their service "very soon".

Laidian Technology Co — one of Ankerbox's competitors — is also trying to introduce other services, such as inner room navigation, printing and automatic vending.

grace@chinadailyhk.com