Next IMF boss must defend open world economy in testing times

By Harvey Morris | China Daily Global | Updated: 2019-07-17 09:43

The appointment of France's Christine Lagarde to head the European Central Bank has created a vacancy at the top of the International Monetary Fund, which was established three-quarters of a century ago as guarantor of global monetary stability.

Since the IMF and the World Bank were set up at the end of World War II to establish a cooperative global economic order after the chaos the conflict had wrought, the former has been led by a European and the latter by a United States citizen.

That convention reflects the economic and political realities of 1945 when the US and Europe dominated the emerging new world order.

There is nothing in the rules, however, to prevent non-Western candidates from taking the top posts. Many have argued that these institutions should cast the net wider to better reflect the realities of the 21st century in which countries such as China now have enormous economic power.

There are no indications that the US and Europe are quite ready to relinquish their hold on the two main global financial institutions. This year, the tradition of naming someone from the US to lead the World Bank was maintained with the appointment of former Treasury official David Malpass as its president.

As for the vacancy at the IMF, France's Finance Minister Bruno Le Maire has already been quoted as saying the top job there should once again go to a European.

Pragmatists would argue that what matters is not where these top officials come from but rather the policies they pursue. The IMF has been widely criticized over the years for pursuing Western interests by imposing austerity on developing countries in return for its fiscal support.

In a world in which trade tensions are building and the model of wider globalization is under threat, there is, more than ever, a need for consensus in the top financial institutions, to preserve the benefits of cooperation.

Lagarde's leadership of the IMF was viewed positively in Beijing, which supported her candidacy for the post she took up in 2011. She backed the inclusion of the Chinese yuan into the IMF's currency basket, previously made up of dollars, yen, pounds, and euros.

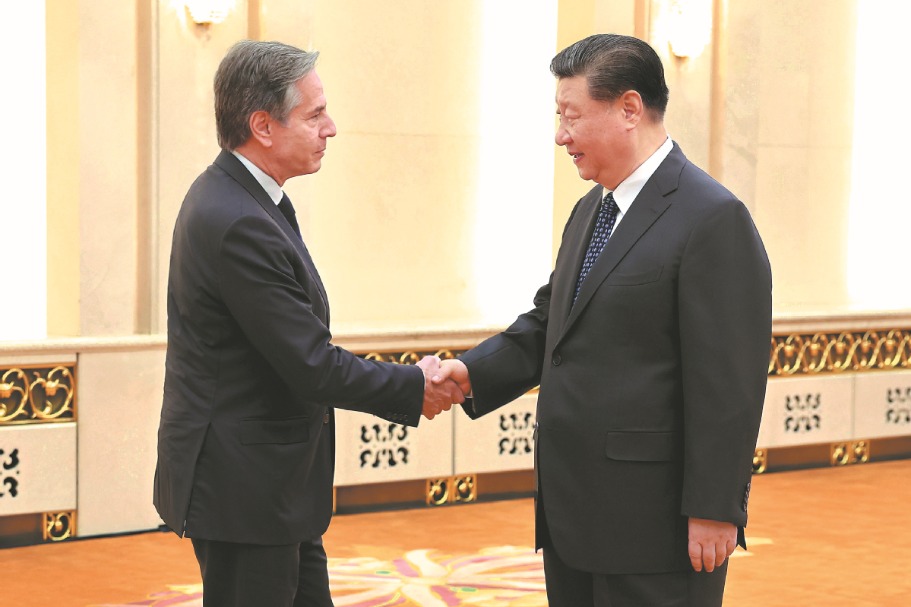

Lagarde established a good relationship with Chinese leaders, and was among world leaders who were in Beijing in April to discuss investment opportunities in the Belt and Road Initiative. President Xi Jinping said that, in advancing the BRI, China was applying debt sustainability criteria recommended by the IMF.

So what can China and other IMF participants expect of Lagarde's successor, European or not?

The key credential of the next IMF chief will be to defend the interests of the new world economic powers while maintaining the trust of the US and Europe. One of the key challenges will be dealing with an irascible and unpredictable White House.

Poorer developing countries will need to know that, if economic disaster strikes, the IMF will be there to bail them out without imposing crippling terms.

There has been speculation that, given Asia's new role in the global economy, the IMF might break with tradition and appoint a non-Westerner. The New York Times reported that early shortlists for the top job included Singapore's Tharman Shanmugaratnam and Egyptian-American businessman Mohamed El-Erian.

The potential European candidates include the Bank of England governor Mark Carney, a Canadian who also has British and Irish citizenship.

China already has one of the most senior posts at the IMF, with former People's Bank of China official Zhang Tao serving as its deputy managing director.

High on the new IMF chief's agenda will be confronting the impact of President Donald Trump's trade war on China, which Lagarde recently warned threatens global economic growth and which may cost $455 billion in lost output next year.

She said there were growing concerns that the most recent US-China tariff s could further reduce investment, productivity and growth and that Trump's threats of tariffs on Mexico were also of concern.

The World Bank has been equally gloomy, predicting that increased political uncertainty would push down world growth to 2.6 percent this year, its weakest since 2016.

"These are self-inflicted wounds that must be avoided," Lagarde said. "How? By removing the recently implemented trade barriers and by avoiding further barriers in whatever form."

Any downturn will impact smaller economies as well as large ones, obliging the new IMF chief to deal with emerging crises. The IMF is due to disburse a new tranche of aid to Argentina any day now.

At the end of the day, the nationality of the new IMF chief is perhaps the least important thing to consider about Lagarde's successor.

As the Financial Times commented: "Far more important than nationality is the ability to do one job above all: to use the fund's weight to defend the open world economy and help sustain global cooperation."

Harvey Morris is a senior media consultant for China Daily UK.