Tech firms to benefit from innovation

By Zhou Lanxu | China Daily | Updated: 2020-01-08 10:35

Registration-based IPO reform to play key role in high-quality development

China's A-share market is finally going to see the first initial public offering of a firm with dual-class shares, a special equity structure used by overseas public tech firms, which received the regulatory nod last month.

The China Securities Regulatory Commission, the country's top securities regulator, said on Dec 24 that it had agreed the IPO registration of UCloud Technology Co Ltd, a Shanghai-based cloud computing services provider, signaling that the company will debut soon.

Upon a fully subscribed IPO, UCloud's three co-founders will retain 23 percent of the company's total shares but 60 percent of the voting rights because of the dual-class share structure.

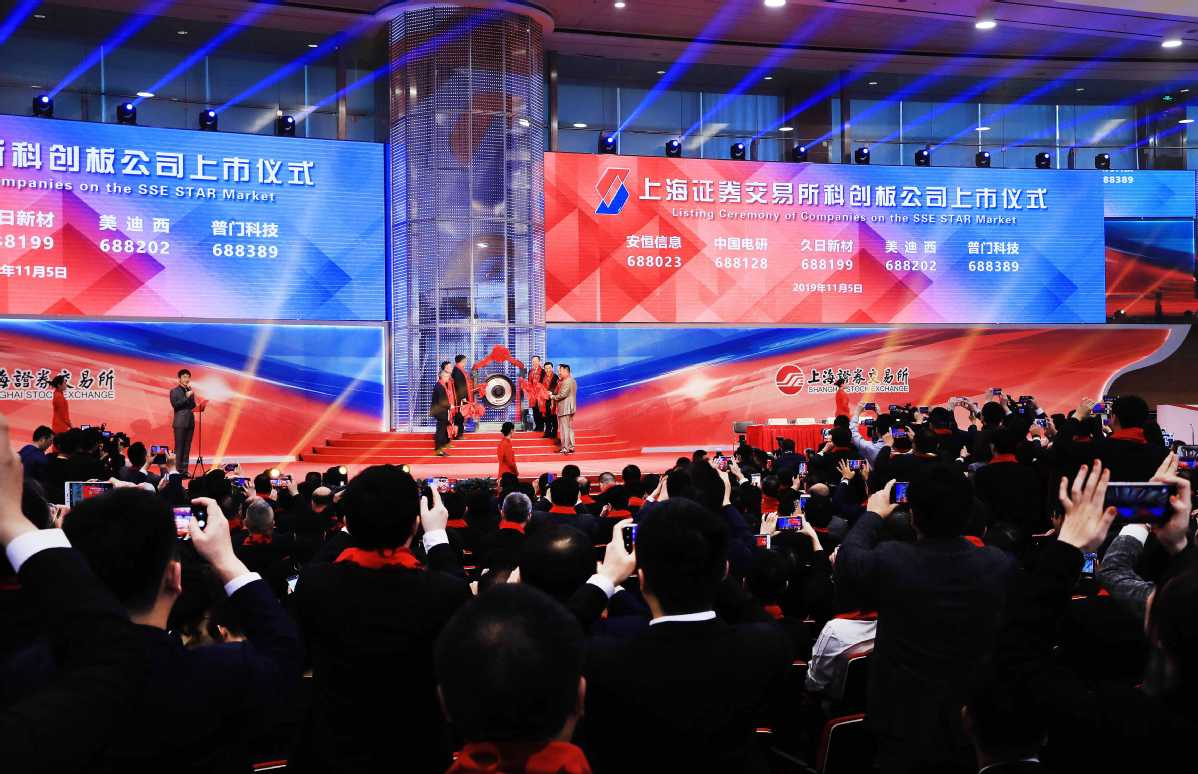

This first A-share IPO allowing dual-class shares resulted from the optimization of listing standards on the sci-tech innovation board, or STAR Market, which debuted on the Shanghai Stock Exchange in July.

Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, said the IPO registration of UCloud reflects the STAR Market's inclusiveness to innovative enterprises, which is unprecedented in the history of the A-share market.

"The biggest innovation of China's capital market in 2019 was the launch of the STAR Market with the registration-based IPO system. This marks the determinant battle of capital market reforms and has profound implications," Dong said.

For many tech firms with strong management teams, the dual-class share structure is critical, as it will guarantee founders' control over the company despite enormous equity financing, according to Dong.

Other groundbreaking listing standards friendly to tech firms have also taken effect. As of Jan 7, one red-chip firm, which is based on the mainland but was incorporated overseas, had passed reviews for STAR Market IPOs and are awaiting registration with the CSRC, according to market tracker Wind Info. One firm yet to make profits is expected to get listed next week.

President Xi Jinping announced in November 2018 that China would launch the STAR Market and pilot the registration-based system. The country's top leadership said this is an important move for China to both support innovation in key technologies and push ahead reforms in fundamental institutions of the capital market.

As well as attracting tech firms, the STAR Market is performing a role spearheading registration-based reforms such as those relating to market-oriented share pricing, market data show.

The STAR Market has removed the unwritten price-to-earnings ratio ceiling of 23 for IPOs and strengthened information disclosure to ensure investors are well-informed to price the offerings. Listed companies were priced at about 60 times earnings per share on average in 2019, according to Wind Info.

Also, eased secondary-market trading limits, especially the removal of price fluctuation limits during the first five trading days, have shortened the time of initial speculative trading and helped stock prices to reflect the value of listed firms faster, analysts said.

An index compiled by GF Securities that tracks stock prices of STAR Market-listed companies hit the highest level on the 11th trading day of the new board. By contrast, it took nearly 25 days for the ChiNext, Shenzhen's innovative enterprise-heavy board that debuted in 2009, to stop the initial stock price surge driven by investor enthusiasm.

Based on the experience of the STAR Market, the country is ramping up registration-based reform efforts on other A-share submarkets.

On Dec 28, the nation adopted the revised securities law and amended new share sales arrangements to set the basis of registration-based reform across the whole A-share market step-by-step, with the ChiNext to be the next test board for the registration-based system.

The registration-based reform led by the STAR Market will play a key role in China's high-quality development, according to analysts.

Unlike the past 40 years when industrialization powered China's growth, the new economy backed by technological innovation will be the main driver of future economic development, said Xiao Gang, a national political adviser and former chairman of the CSRC.

To fit such economic upgrading, China's bank-dominated financing system will also undergo major changes. The capital markets, with multilayered systems that cater to enterprises in different stages, will play a more important role, according to Xiao.

"New risks come with new technologies, so we need a financing mode whereby the fund provider and the fund receiver will bear the risks and reap the returns together. This is what capital markets do," Xiao said at a policy panel at Tsinghua University in December.

Implementation of the registration-based system, meanwhile, will help the country's capital markets to enhance their ability to serve the new economy by driving systemic reforms, according to Xiao.

Without the registration-based system, it would be difficult to either enforce stricter delisting rules or reform how the securities regulator functions, let alone intensifying crackdown on legal breaches and strengthening investor protection, Xiao said at a separate forum recently.

Looking ahead, analysts expect the market scale of the STAR Market to rapidly grow to accommodate tech giants, better performing its function of sharpening the country's technology innovation capacity.

Li Daxiao, chief economist with Yingda Securities, said this would entail both a faster pace of IPOs and listing of firms with larger market capitalization and business revenue, such as those comparable to Ant Financial and ByteDance.

A report from GF Securities said between 160 and 180 firms are expected to list on the STAR Market this year, up from 70 last year, adding that the market may welcome its official index "STAR 50" in the first quarter.

Moreover, the "the sci-tech Q board" in the pipeline has big potential to coordinate with the STAR Market to promote the development of high-tech companies, said Xue Yi, a professor of finance at the University of International Business and Economics.

The Shanghai Equity Exchange said in December that it will establish the sci-tech Q board, where Q represents quotation, to nurture more companies suitable for STAR IPOs.

Companies above a certain size and with the potential to file IPO applications on the STAR Market in the next few years will be qualified to list on the Q board, whereby they could disclose company information, offer stock quotes online, and transact equities offline, the exchange said.

The Q board could address the weak link of the STAR Market whereas it cannot serve the financing needs of small high-tech companies, Xue said. "Information disclosure before IPOs will help mitigate information asymmetries and attract more investors, reducing financing costs faced by small high-tech companies."

If the Q board's quotation system grants companies the right to choose investors, it can go a long way toward maintaining their innovative capacity, as they could choose investors that attach less importance to short-term financial performance but encourage long-term innovation activities, Xue said.

For the STAR Market to become a real success, several reforms should be pushed ahead, such as introducing more long-term institutional investors, and formulating policies to address concerns of red-chip companies considering listing on the new board, said a report from the Evergrande Research Institute.

"The STAR Market has just started a groundbreaking journey, and there is still a long way to go to fulfill its ambitious commitment," it said.