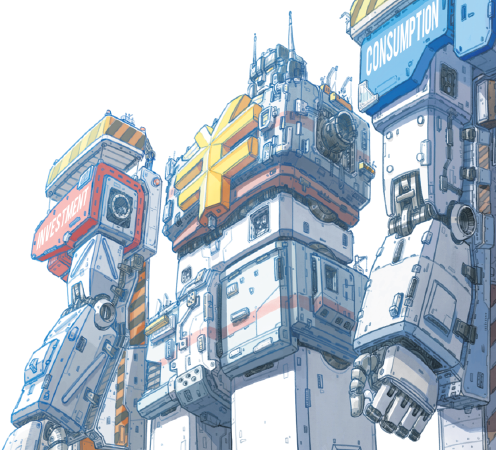

Spending power

By GORDON ORR | China Daily Global | Updated: 2020-02-18 08:30

Despite external pressure of deglobalization, consumption will open up new business opportunities in China and the country's importance to global businesses will continue to grow

The outbreak of the novel coronavirus is having a major impact on the Chinese economy as opportunities to spend on goods and services have been severely curtailed. After the epidemic peaks in the coming weeks and people return to work after the extended Spring Festival holiday, that postponed consumption will likely reemerge and the underlying consumer trends driving the Chinese economy will get back on track.

China's economic momentum in 2020 requires domestic consumption to lead the way. Consumer retail spending in the first 10 months of 2019 rose 8 percent year-on-year, ahead of income growth of roughly 6 percent. Over 10 million new jobs were created. With moderate growth in property prices and a positive year in the domestic stock markets over the last year, middle-income consumer confidence remained positive.

More and more consumer purchases are now financed through installment payment schemes, through credit cards and bank debt (now well over $1 trillion). But the average Chinese consumer is not yet overleveraged (total household debt stands at only 60 percent of GDP), although the 20-30 age group who borrow most enthusiastically are getting there, pulling forward consumption from future years. This age group also sustains higher current spending by not entering the property ownership market.

For many, property prices are now so high it is simply not possible until much later in life. Many realize that renting is a better economic option. A recent Jones Lang LaSalle report showed the average price of renting in top Chinese cities was less than half the average mortgage payment.

Multiple consumer sectors have suffered significant demand weakness. Yet many service sectors are thriving. Private education providers with quality facilities and faculty are one example, especially those with internationally focused curricula.

Meanwhile, greater food safety and personal health awareness (which has supported the boom in gyms in China) have led many middle-income Chinese to embrace healthier eating choices. Restaurants are adding more vegetarian options, and plant-protein based meat replacements are gaining traction. In China, which consumes more than 50 percent of pork produced globally and has seen pork prices rise over 100 percent due to the African swine fever, the need is for pork alternatives. As a result, Asian companies such as Green Common from Hong Kong have taken the lead in meeting this demand.

The government is getting more involved, requiring manufacturers to provide additional labeling information. In 2020, the government will require that labels on foods show their glycemic index (GI), a rating of how the carbohydrates impact blood glucose levels. The government is acting in an attempt to impact the explosion in diabetes and obesity across China. If the experience of launching this index in Australia provides guidance, food manufacturers will reformulate their products to reduce their GI rating and will market aggressively on the back of having done so, leading to a boom in consumer demand for lower GI products.

With China's food delivery services providing more than 40 million meal deliveries a day and the number growing 35 percent year-on-year, Meituan and Eleme have a key role to play in shaping food consumption in China. To meet this demand, they will be promoting healthier options and providing more information to consumers on their choices, whether it is lunch delivered to the office or dinner to the home.

A rebound in automobile sales is unlikely this year. But a growth bright spot for the industry will be electric vehicles. Again, local governments will play a critical role along with changing consumer tastes. Cities are switching their bus fleets to electric-close to 25 percent of all buses sold in China will likely be electric in 2019, perhaps 35 percent in 2020 and are mandating that taxi fleets become electric, as well as reducing the cost of acquiring a license plate for electric vehicles. Cities are rolling out networks of charging stations well ahead of demand. It is common to see car parks where the only spaces are those next to the electric vehicle charging stations.

Middle-income consumers who are increasingly sensitive to air pollution are investigating electric vehicles and realizing that their range exceeds that which they ever travel in a single car journey. Between 2019 and 2021, it is expected that more than 200 different models of electric vehicle will be launched. Electric vehicles represented close to 5 percent of automotive sales in 2019(up to 20 percent in major cities) and could easily step up to 7 percent in 2020 if the central government decides to include electric vehicle subsidies in any stimulus program.

China's electric vehicle market is already three to four times the size of the US market, and it will continue to grow, giving market leaders in China the opportunity to become world leaders in developing and manufacturing electric vehicles, their batteries, and charging infrastructure.

The year 2020 is the final year in China's decade-long endeavor to double its GDP, and the government will be able to declare success. US tariffs will continue to have minor impact on Chinese growth. Domestic consumption and investment will remain the key economic drivers, and China will deploy targeted stimuli to maintain momentum.

Many businesses will find 2020 a challenging, stressful year in China. Yet China will only grow in importance to the majority of global businesses-as a source of global demand, of innovation, of capital and of newly emerged world-class competition. Despite external pressure to deglobalize, global businesses will evolve their supply chain, their operating model, and even their ownership structure if needed to remain relevant in China.

The author is a senior partner emeritus and senior advisor to McKinsey & Company. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.