With new phones, 'Honor' is restored, market foothold firm

By MA SI | China Daily | Updated: 2021-06-18 09:23

Company carved out of Huawei first to use Qualcomm's 778G 5G chips

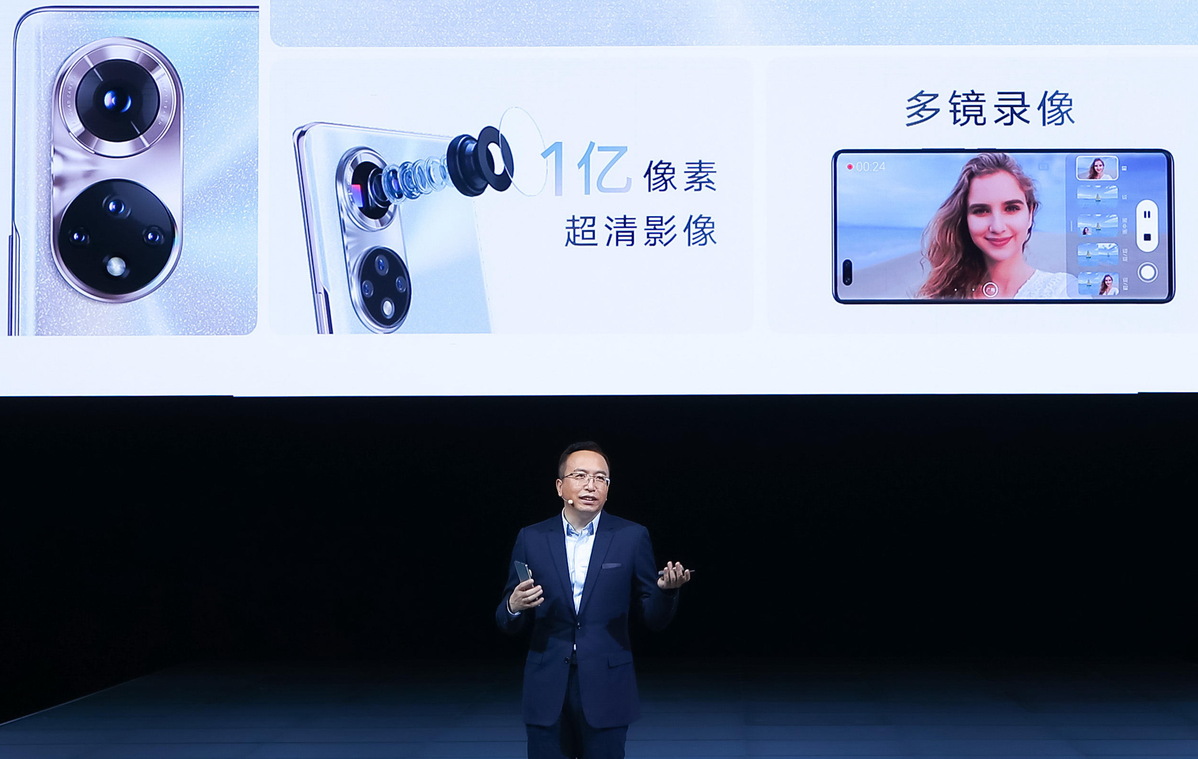

Honor Device Co Ltd, the Chinese phone maker that became independent from Huawei late last year, said its supply chain has fully recovered and the company is steadily regaining market share.

The comments came after the company unveiled its new smartphone 50 series powered by the US chip giant Qualcomm's chips on Wednesday night.

Zhao Ming, CEO of Honor, said though the company obtained the chip information 45 days later than its competitors, Honor managed to be the first in the industry to launch smartphones powered by Qualcomm's 778G 5G chips.

The company has so far reestablished links with over 30 strategic partners, and inked more than 1,000 supply agreements, he said.

"The darkest months for Honor are over. Our market share in the Chinese smartphone market had recovered to 9.5 percent in the last week of May," Zhao said.

"In the past 211 days, a lot of things had happened. At the peak point, we were the second largest smartphone brand in China with a market share of 16.7 percent. And then we plummeted all the way to 3 percent at the darkest moment,"Zhao said.

The slump came after the United States restrictions on Huawei cut its access to crucial technical components for its mobile phone business. In November, Honor was sold by Huawei to a Chinese consortium of over 30 agents and dealers to ensure the brand's survival.

Asked whether Honor will adopt Huawei's self-developed operating system HarmonyOS in the future, Zhao said currently Android is still its preferred choice, but he did not rule out the possibility of switching the operating systems.

"As an independent company, Honor can choose different operating systems at the appropriate time in accordance with its development," Zhao said.

The senior executive said Honor will further expand its retail footprint in the country by setting up offline stores in more cities. "We have opened over 2,500 new experience stores and centers," Zhao said.

Priced from 2,699 yuan ($420) in China, the Honor 50 series smartphones are the second batch Honor unveiled after splitting off from Huawei. The model's launch comes in the wake of mobile phone shipments in China experiencing a 32 percent year-on-year decline to 22.97 million units in May, according to data from the China Academy of Information and Communications Technology, a Beijing-based think tank.

But it is worth noting that in the same time frame, domestic shipments of 5G phones witnessed a 7 percent year-on-year increase to 16.74 million units.

Honor 50 smartphones will also be available in international markets outside of China later, including France, Malaysia, Mexico, Russia, Saudi Arabia and the United Kingdom, the company said.

Market research company Canalys forecast that the worldwide smartphone market will grow 12 percent in 2021, with shipments reaching 1.4 billion units. This represents a strong recovery from 2020, when shipments fell 7 percent due to major market constraints caused by the COVID-19 pandemic.

Ben Stanton, research manager at Canalys, said: "The smartphone industry's resilience is quite incredible. Smartphones are vital for keeping people connected and entertained, and they're just as important inside the home as outside. In some parts of the world, people have been unable to spend money on holidays and days out in recent months, and many have spent their disposable income on a new smartphone instead."

But component supply bottlenecks will limit the growth potential of smartphone shipments this year. "Back-orders are building. The industry is fighting for semiconductors, and every brand will feel the pinch."

In recent months, vendors redirected some lots to other regions due to the COVID-19 outbreak in India, but this option is not sustainable as the world returns to normal.

Vendors will first prioritize regional considerations, focusing on the flow of units into lucrative developed markets such as China, the US and West Europe at the expense of Latin America and Africa, Canalys said in its latest report.

Nicole Peng, vice-president of mobility at Canalys, said as key components like chipsets and memory increase in price, smartphone vendors also have to decide whether to absorb that cost or pass it on to consumers.

Smartphone vendors must look at improving their operational efficiency while lowering margin expectations in their low-end portfolios for the duration of the constraints, or risk ceding market share to their competitors, Peng said.