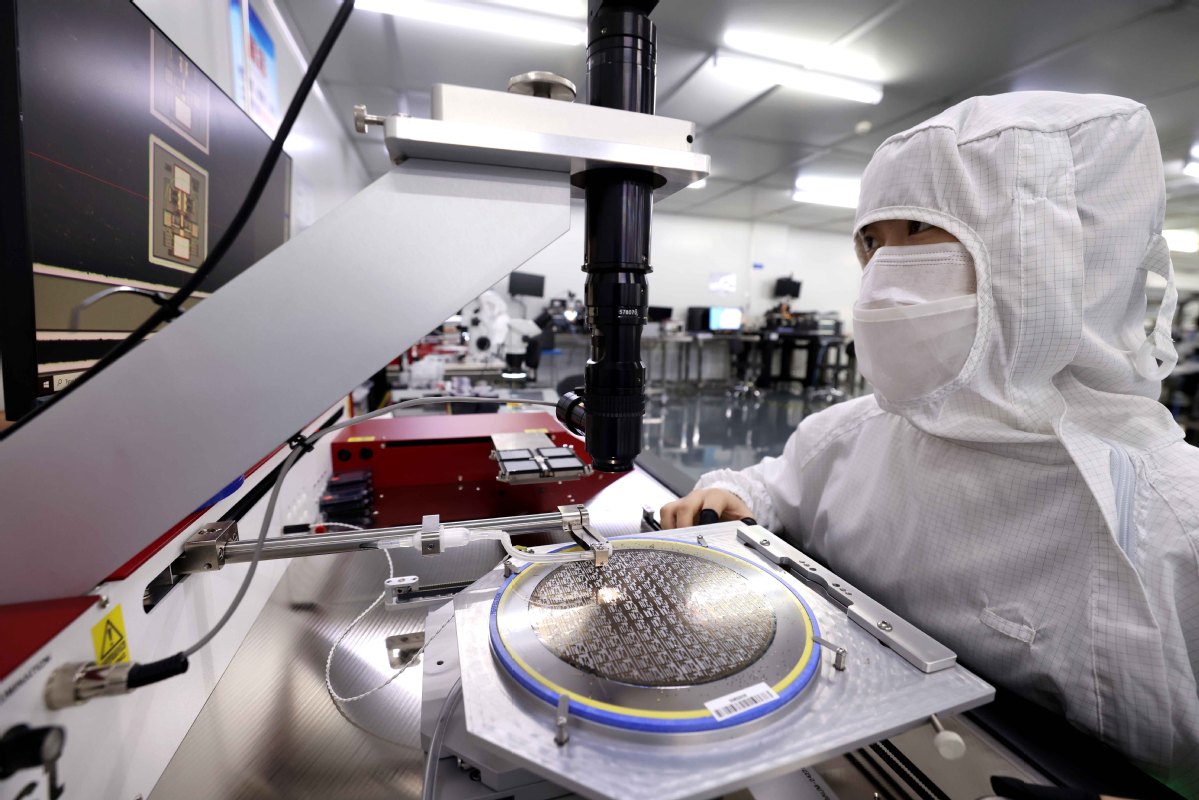

Chips are down as demand on decline

By MA SI | CHINA DAILY | Updated: 2022-07-14 07:39

A global chip shortage that has lasted for about two years is seeing a sudden shift into oversupply in semiconductors for smartphones and personal computers, as consumer demand for certain electronics has been weaker than expected of late, experts said.

The comments came after global PC shipments experienced the sharpest decline in nine years during the second quarter, which reduced the sector's demand for chips, according to market research company Gartner Inc.

Mikako Kitagawa, research director at Gartner, said the first-quarter decline has accelerated in the second quarter, driven by factors including inflationary pressure on spending and a steep downturn in demand for Chromebooks.

"Supply chain disruptions also continued, but the major cause of PC delivery delays changed from component shortages to logistics disruptions," Kitagawa said.

Chipmakers are among the first to notice the trend of declining demand. US chip company Micron Technology Inc said in late June that it would reduce production, raising concerns that following nearly two years of strong demand, the semiconductor industry was turning toward a down cycle.

The same thing also happened in the global smartphone market. Though the latest data for the second quarter has yet to be released, first-quarter data showed that global smartphone shipments were down 11 percent year-on-year to 311.2 million units, according to market researcher Canalys.

In April, China's mobile phone shipments stood at 18.08 million units, a year-on-year decrease of 34.2 percent, said the China Academy of Information and Communications Technology.

Xu Qi, vice-president of Realme, an up-and-coming Chinese smartphone brand, said earlier that the shortage of mobile phone chips has eased since the beginning of this year and prices of some chips have declined.

Weaker demand for smartphones and personal computers affects the global semiconductor sector, said Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association.

That marked a reversal from the situation in the previous two years, when crimped chip supplies struggled to match growing demand from makers of digital products and service providers amid accelerated digital transformation necessitated by COVID-19.

Though a chip glut emerged in some sectors, the automobile industry's demand for semiconductors still remained healthy, Xiang said.

Kurt Sievers, CEO of NXP Semiconductors, the world's top chip manufacturer for the auto industry, said earlier that as automobiles get increasingly electrified, smarter and connected to the internet, the number of electronics per car is growing rapidly, which spurs demand for auto chips. China is going to see strong growth in this aspect in the next few years.

masi@chinadaily.com.cn