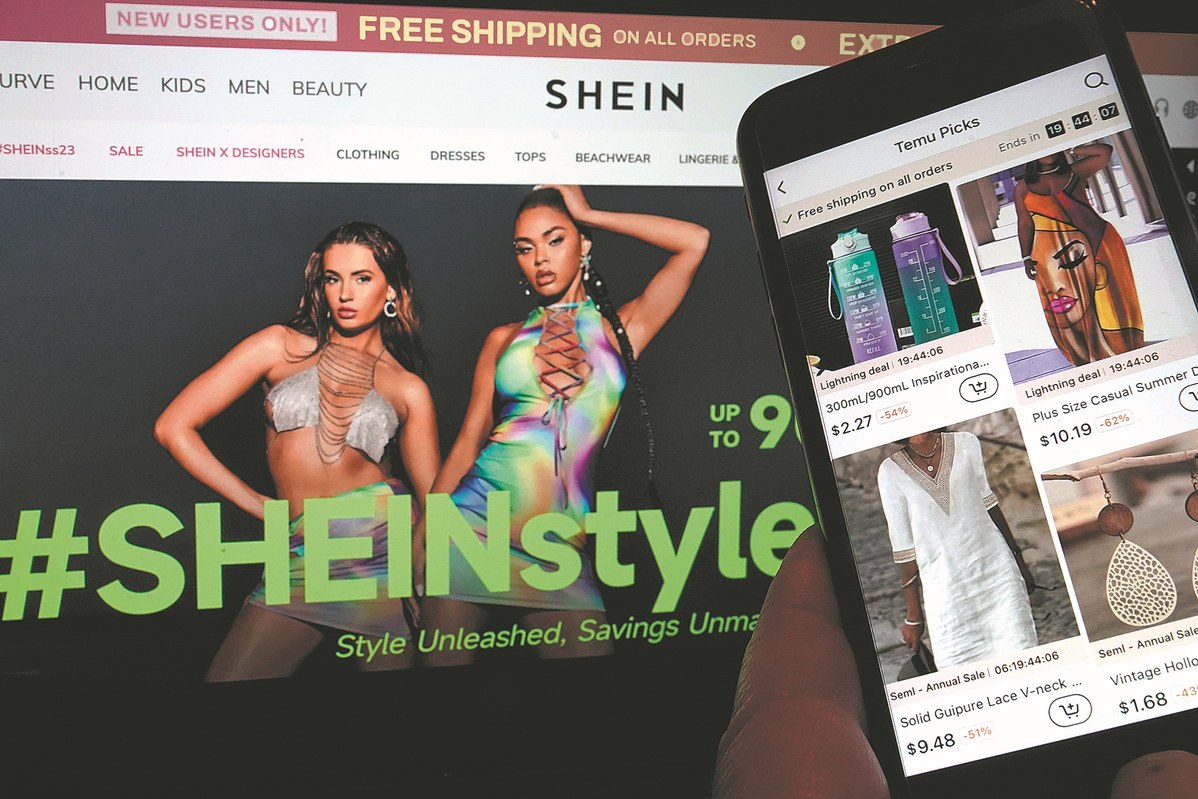

Fast-fashion sites grab major share of foreign market

By MINGMEI LI in New York | China Daily Global | Updated: 2023-08-09 07:45

Online fast-fashion retailers from China are making significant strides in the US fashion industry and steadily gaining market share, according to the latest industry figures.

The e-commerce platforms have become thriving hubs for both buyers and sellers, spurring the growth of international trade for Chinese businesses, with two shopping sites — Shein and Temu — attracting much of the attention from US consumers.

The major players are leveraging affordable prices, free shipping, regular discounts and flexible return and refund policies. Last year, the digital clothing platform Shein was downloaded 200 million times, surpassing Amazon as the most downloaded app in both Apple and Google stores.

The site has recorded annual revenue of $30 billion and 13.7 million annual users. Compared to major fashion brands such as H&M, Zara or Uniqlo, similar-looking products on Shein are priced lower, often ranging from $20 to $30 apiece. Consumers using its app also receive daily discount coupons, guaranteeing them better prices.

According to the US Bureau of Labor Statistics' Consumer Price Index, apparel prices rose 3.1 percent in the past year. The increase in clothing and footwear costs is putting a strain on the budgets of many US consumers and they are looking for cheaper alternatives, according to analysts.

Shein and Temu strategically entered the US market during a period of relatively high inflation. Last year, the inflation rate for apparel reached 5.03 percent and dropped to 3.17 percent this year.

Apart from being price-driven, the styles and trends of products have also captured millions of customers. Both Shein and Temu have outpaced traditional US brands with their faster rollout speed. Data collected by Rest of World revealed that between July and December 2021, they added between 2,000 and 10,000 SKUs (stock-keeping units, or individual styles) to their apps each day.

Drawing on a user experience approach similar to its parent company Pinduoduo, which is a top competitive retailer in China, Temu has rapidly attracted US customers.

Unlike Shein, which mainly sells branded apparel, Temu operates more like a marketplace, also selling home appliances, furniture and other accessories. According to Bloomberg Second Measure, spending on Temu was 20 percent higher than the more established fast-fashion retailer Shein in the US in May.

Shein and Temu have been entangled with lawsuits back and forth for months, while other small Asian e-commerce platforms like TikTok Shop, AliExpress and Wish are also entering the US market.

Shein and Temu also attract Asian customers in the US.

"It makes me feel at home, like shopping with Taobao," said Cici Wang, an international student at New York University, referring to the popular Chinese e-commerce platform. "The products are cheaper and cuter than those on Amazon."