IMF: China has taken action on property market problems

By ZHAO HUANXIN in Washington | China Daily Global | Updated: 2023-10-11 10:11

China's near-zero inflation means it has space to ease monetary policy, and it has taken "welcome" measures to address its property market woes, a factor that led the International Monetary Fund to cut the country's GDP growth to 5 percent in 2023.

In its latest World Economic Outlook released on Tuesday, the IMF revised China's growth downward by 0.2 percentage point for 2023, and by 0.3 percentage point for 2024 to 4.2 percent, citing lower investment amid a "property market crisis" as the main contributor to the revision.

IMF chief economist Pierre-Olivier Gourinchas said looming large over China's growth prospects is what he called a real estate crisis in China, where there are a number of pre-sold units that have not been completed, and developers face financial difficulties, resulting in downward pressure on and a lack of confidence in the real estate market.

"Clearly, what this calls for is forceful action by the authorities to help — for instance, you know, restructure struggling property developers — to make sure that there isn't any increase in financial instability," Gourinchas told a briefing on Tuesday during the annual meetings of the IMF and World Bank in Marrakech, Morocco.

"We've seen some measures that have been taken in recent months, in recent weeks," he said. "These measures are welcome, but they need to be at scale."

In a statement issued on Sept 26 at the conclusion of its discussion of the World Economic Outlook, the IMF Executive Board also said, "Most Directors noted the risk of a further deterioration in China's property sector and, in this regard, welcomed the recent policy actions taken by the authorities."

The property sector has been a pillar of China's economy but has dragged on its economic recovery.

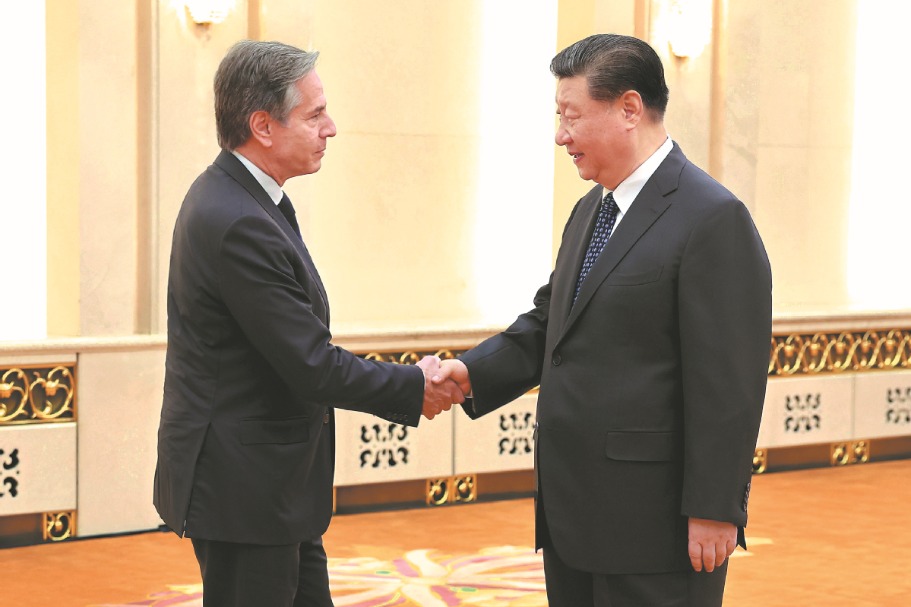

Chinese President Xi Jinping has underscored the significant impact of the real estate sector on other facets of the country's economic and social development.

In an article published in February in the journal Qiushi, the flagship magazine of the Communist Party of China Central Committee, he called for efforts to effectively forestall and defuse systemic risks arising in the property sector.

Following a crucial meeting of the Political Bureau in late July that decided property policies should be adjusted and optimized in a timely manner, authorities issued a series of measures on Aug 31, including adjustments to ease restrictions on the classification of first-home buyers, lower existing first-home loan rates and extend tax incentives.

The mortgage interest rate for first-time buyers should be no less than the level of 20 basis points over the loan prime rate (LPR), according to a statement issued by the People's Bank of China, the central bank, and the National Administration of Financial Regulation.

As a result, trading in the real estate market has become brisker. In September, the total sales of the country's top 100 real estate developers surged 24.8 percent month on month, the Xinhua news agency reported last week.

At the news conference, Gourinchas also said China's monetary policy can "certainly" help its economy.

"There's a sense in which monetary policy can be eased. China is in a very different place than the rest of the world in terms of the inflation pressures. If anything, their inflation numbers are below target, so they have room to ease monetary policy," he said.

Worldwide, even as central banks have taken decisive action, inflation remains above target in almost all economies with an inflation target, the IMF said.

It said that among major central banks with inflation above target, the Bank of Canada, the Bank of England, the European Central Bank, and the Federal Reserve all raised rates in July.

"The largest exception to this pattern is China, where headline inflation is subdued and below the authorities' target, and the People's Bank of China reduced interest rates in June and August," it added.

The central bank cut the one-year loan prime rate in June and August by 25 basis points in total. The one-year LPR was 3.45 percent last month, while the five-year LPR, on which lenders base their mortgage rates, was unchanged at 4.20 percent.

Global core inflation, excluding food and energy prices, is down from a peak of 8.5 percent in the first quarter of 2022 (at a quarterly annualized rate) to 4.9 percent in the second quarter of 2023, nearly two-thirds of the way back to the pre-pandemic annual average of 2.8 percent.

China's core inflation in the second quarter of 2023 was 0.3 percent, compared with 4.6 percent in the euro area and 4.7 percent in the United States, according to the latest IMF statistics.

That means China will have room to support the household sector on the fiscal side, by redeploying some of the fiscal measures and helping households and consumers.

"So these are sort of the measures we would encourage the authorities to undertake, and I think they are moving in that direction and this is to be welcome," Gourinchas said.

Gourinchas also noted that typically, when the IMF estimates there is one percentage point lower growth in China, it translates into something like 0.3 percentage point lower growth in the rest of the world.

To avert the likelihood of China's economy further slowing down, a possible downside risk to global growth, the IMF said there should be effective policy response in preserving financial stability.

That could be achieved by expediting the restructuring of struggling property developers, facilitating the completion of housing projects, and addressing the growing strain in local government finances, all of which would help restore business and consumer confidence.

"Policy space has shrunk but is not fully exhausted. Given the lack of inflationary pressure, the People's Bank of China has some room to ease," it said.

Stronger policy support in China than currently envisioned –– through means-tested transfers to households in particular –– could bolster the recovery and generate positive global spillovers, the IMF said.

Globally, growth is projected to fall from 3.5 percent in 2022 to 3 percent in 2023 and 2.9 percent in 2024. The figure for next year is 0.1 percentage point lower from the IMF's July projection.

Gourinchas said the weaker growth prospects also reflect the rising incidence of climate risk, with increased frequency of large natural disasters and rising geo-economic fragmentation, such as the trade tensions leading to potential US China decoupling.

"While some countries may benefit in the short term, in the medium term, all lose. Multilateral cooperation can help reverse some of these headwinds for the world economy," he said.