Chinese yuan continues to weaken against USD

(Xinhua) Updated: 2016-10-25 10:06BEIJING - The Chinese yuan continued to weaken on Tuesday, with the fix breaking its six-year low against the US dollar for a third trading day.

The central parity rate of the Chinese currency renminbi, or the yuan, weakened 54 basis points to 6.7744 against the US dollar, according to the China Foreign Exchange Trading System.

It was the weakest level since September 2010 as increased market expectations for an interest rate hike in the United States led to a stronger dollar.

But the depreciation markedly narrowed from 132 and 247 basis points on Monday and Friday, respectively.

"There's no basis for persistent depreciation of the yuan," Yi Gang, deputy governor of the People's Bank of China, said in an article published Tuesday on the People's Daily, a leading newspaper in China.

Yi said China's sound economic fundamentals will help the currency remain stable around a reasonable level.

In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2 percent from the central parity rate each trading day.

The central parity rate of the yuan against the US dollar is based on a weighted average of prices offered by market makers before the opening of the interbank market each business day.

- China's HNA to buy 25% stake of Hilton for $6.5b

- Chinese yuan weakens to 6.7744 against USD Tuesday

- US sets final dumping and subsidy rates on iron mechanical components from China, Canada

- Bearish traders lose big on milk

- Yili shares surge on Shengmu purchase

- SOEs hit reduction goal

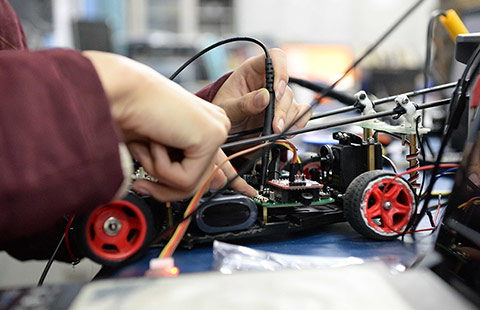

- University tie-ups unleash innovation

- Pledge on AT&T offers fees and risks