|

BIZCHINA> Top Biz News

|

|

Commodity rally lifts share prices

(China Daily/Agencies)

Updated: 2009-09-18 08:40

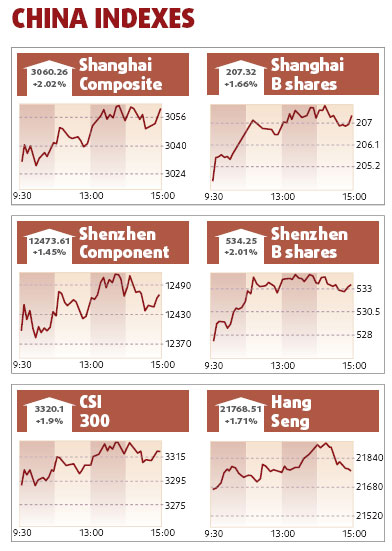

Chinese stocks advanced to a one-month high, led by raw-materials producers, after commodity prices rallied amid speculation the global economy has returned to growth. "A global recovery will strengthen China's growth by increasing the external demand for Chinese products," said Zhao Zifeng, who helps oversee about $10.2 billion at China International Fund Management Co in Shanghai. "Confidence about both domestic and global economies is picking up and the equity rally may last until the end of the month." The Shanghai Composite Index rose 2 percent to 3,060.26 at the close, the highest close since Aug 13. The CSI 300 Index gained 1.9 percent to 3,320.10. PetroChina rose 1.9 percent to 13.76 yuan. Yunnan Copper climbed 1.2 percent to 30.86 yuan. Aluminum Corp of China Ltd gained 1.7 percent to 15.07 yuan. Crude oil increased 2.2 percent to $72.51 a barrel, while gold futures added 1.4 percent to a record settlement price. A gauge tracking six metals including copper and aluminum gained 3.7 percent in London on Wednesday. Shenhua, the nation's largest coal producer, rose 3.4 percent to 34.74 yuan. The company said coal output in August climbed 13.3 percent from a year earlier and sales gained 8.3 percent.

"It looks like the worst is over and the fact that the recovery is well under way has lifted the confidence among investors," said Zhang Kun, a strategist at Guotai Junan Securities Co. "The rebound is likely to carry on." Chinese stocks may rally in the next two weeks as the government takes steps to boost sentiment before the National Day holidays, Hong Kong-based Fulbright Securities said. Hang Seng up Hong Kong stocks advanced, led by resource companies, as commodity prices gained and Sinopharm Group Co raised the maximum amount it sought from its initial public offering. The Hang Seng Index gained 1.7 percent to 21,768.51 at the close, its highest since Aug 11, 2008. The Hang Seng China Enterprises Index, which tracks H shares of mainland companies, rose 1.1 percent to 12,668.25. (For more biz stories, please visit Industries)

|