Top Biz News

Copper imports to fall slightly in Nov

(China Daily)

Updated: 2009-12-09 07:57

China's November imports of unwrought copper and semi-finished copper products are expected to be flat, or fall slightly from the previous month, limited by strong London Metal Exchange (LME) prices and abundant domestic supplies.

Imports of refined copper, the most popular type of copper in international and Chinese markets, dived 40 percent to 169,374 tons in October from the previous month, much lower than the 230,000 tons expected by traders and analysts, thanks to delays in contracted shipments.

"Imports are unlikely to recover in November, given poor margins throughout the month," said Zhu Yanzhong, an analyst at Jinrui Futures, a subsidiary of top smelter Jiangxi Copper.

Traders said most delayed shipments would arrive between December and February next year.

November's inflows of refined copper are seen at the 160,000-ton level, or falling to just above 150,000 tons, traders estimated.

Refined copper imports took up 64.4 percent of October's inflows of unwrought copper and semi-finished copper products. Based on that ratio and estimated refined copper imports of 160,000 tons, the data to be released on Friday may show imports of copper and products of 248,447 tons.

| ||||

"Only some small-term cargoes arrived to us in November. Our feeling is that imports were less than October," a warehouse source in Shanghai said.

Reduced imports and increased exports, which jumped to above 18,000 tons in October, more than a third of the year-to-date total, have reduced stocks in bonded warehouses in Shanghai, traders said.

Some 200,000-250,000 tons of imported refined copper cathode were estimated to lie in Shanghai's bonded warehouses versus more than 250,000 tons a month earlier.

That stock level was still high as owners were unwilling to sell the metal on to the domestic spot market in which copper has traded below the cost of imports for much of the past three months.

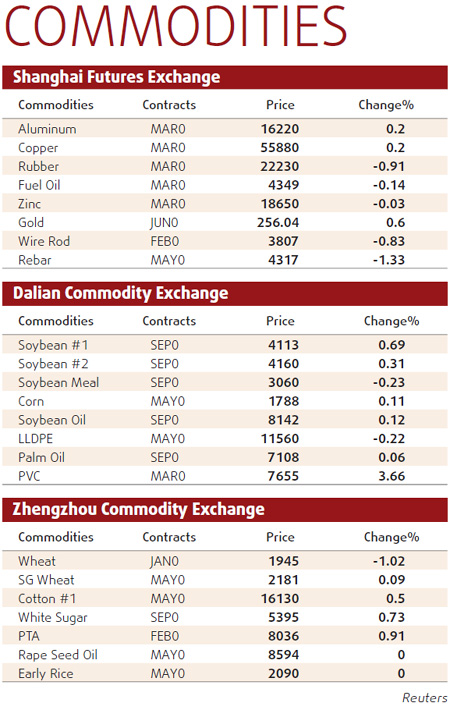

Copper prices were steady yesterday. Three-month LME copper rose $23 to $7,022 a ton in early trade. The benchmark third-month copper futures contract on the Shanghai Futures Exchange was little changed to close at 55,600 yuan a ton.