Top Biz News

Red hot Shanghai realty sizzles property mart

By Wang Ying (China Daily)

Updated: 2009-12-24 08:05

|

Large Medium Small |

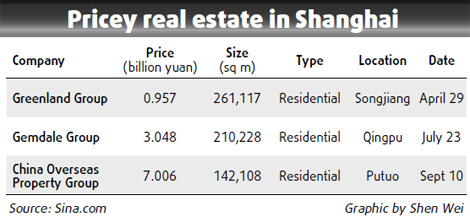

Residential land prices hit a new high yesterday after heavyweight property developers wrangled over a 114,517-sq m piece of real estate in Shanghai.

After several rounds of aggressive bidding, State-owned China State Construction Property Company Ltd bought the parcel for an astonishing 3.72 billion yuan ($545 million) - 217 percent more than the starting price of 1.72 billion yuan. That put the Shanghai property, located in Yangpu district's New Jiangwan City, in the record books at 32,484 yuan ($4,756) per sq m.

Despite government efforts to cool down the overheated property market, Shanghai-based Greenland, Hong Kong-listed China Overseas Property, China Resources Land Ltd, Shanghai-listed Poly Real Estate, Gemdale Co Ltd and Shenzhen-listed Vanke were among the developers jostling over the plot.

Last week the central government toughened property sales rules by requiring buyers to put down at least 50 percent, and pay off the outstanding amount within one year.

The new regulations will likely kick in on Jan 1, 2010, and many investors are trying to beat the deadline.

"In order to complete land purchases before the rule takes effect, many property developers have decided to buy up more land, which is making prices soar," said Chen Sheng, an expert from the China Index Academy, a property research organization.

On Tuesday, a piece of land located in Guangzhou's Asian Games Village was sold for 25.5 billion yuan ($373 million) to R&F Properties, making it the nation's most expensive land.

Sky-high prices are mirroring real estate developers' optimism towards the 2011 property market, according to Chen.

"Although there will be price fluctuations next year, they do believe the market is bullish," he said.

|

||||

However, Chen said the government's housing plan is expected to trigger greater competition as developers realize land is harder and harder to find.

Xue Jianxiong, an analyst with E-House (China) Holding Ltd, said rocketing land prices indicate housing in the area may have to exceed 50,000 yuan ($7,321) per sq m to be profitable, and the price surge will eventually affect neighboring areas.

"As we have seen, the central government is working to take the steam out of the over-heated housing market. At this very juncture, developers and investors must take risks into consideration," Xue said.