Top Biz News

Tough year ahead for exporters

By Ding Qingfen (China Daily)

Updated: 2009-12-25 07:45

|

Large Medium Small |

Firms face uncertainties amid rising trade protectionism.

Though he knows the worst has passed, Tian Feng still cannot relax.

As head of an export-oriented soy protein producer, Tian said his company still faces a lot of uncertainty despite overseas demand rising again in the third quarter of this year.

"We are still very concerned about next year," said Tian, general manager of Sinologry Enterprise Group Co based in the coastal city of Qingdao, Shandong province. What he is worried about is growing trade protectionism against Chinese products.

"Foreign countries may set trade barriers, such as tightening the requirements on inspection and quarantine, to protect local market players," he said.

Tian's worry may be shared by China's tens of thousands of manufacturers and exporters. Chen Deming, minister of commerce, warned yesterday that China's export situation will continue to be "grim" next year despite the improving economic conditions of its trade partners.

"The prospects for export in the year ahead are not very positive, as the world economy will not fully recover from the financial crisis in the short term," Chen told the nation's annual commerce work conference.

"The prospects for export in the year ahead are not very positive, as the world economy will not fully recover from the financial crisis in the short term," Chen told the nation's annual commerce work conference.

Moreover, "as many foreign nations and regions are expected to withdraw their economic stimulus packages during the second half of 2010, China's exporters will face a hard time," Chen warned.

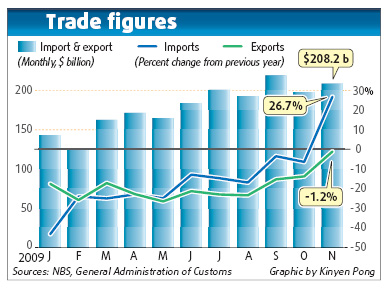

During the third quarter, both the United States and the European Union, China's top two trade partners, reported positive year-on-year economic growth of 2.2 and 0.8 percent, after months of decline. Also, since August, the decline in China's exports has begun to ease, standing at merely 1.2 percent year-on-year in November, and economists predicted positive growth in December.

Although he believes there is little possibility that exports will drop in 2010 compared with this year, Chen doubted growth will remain strong.

"The possibility that China's exports could register high growth in the next year is almost zero," he said, given that "the employment rate (in the US and EU) keeps dropping and the willingness to consume is quite low."

China's exports posted an annual growth of about 25 percent for many years before 2008, but such a rate may not reappear for two or three years, or even longer, he added.

Chen's prediction is echoed by local governments.

"Overseas demand will inch up gradually, but there is no sign of immediate strong growth," said Jin Yonghui, director-general of the Department of Commerce with Zhejiang province.

Based in the nation's leading exporting province, Zhejiang's manufacturers found orders suddenly shrinking late last year.

"Not until this November did orders begin to grow. During the first 20 days of December, exports from Zhejiang surged by 13 percent," Jin said.

Zhejiang's exports are expected to fall by 15 percent year-on-year this year, and are expected to climb by 5 percent in 2010, compared with an annual growth of about 20 percent before the global financial crisis hit the nation's exporters in 2008.

Chen said the central government will focus on "stabilizing export growth by prioritizing exports in key industries next year, including hi-tech, services, media, medicine and culture.

As a large proportion of China's exports are attributable to the China

-based facilities of multinational companies, the nation will try to encourage more overseas investment in selected areas, Chen said.

Since August, China's foreign direct investment (FDI) has started to grow, reversing a 10-month decline that began last October.

"FDI will grow on a gradual basis," Chen said.

As China's efforts to promote domestic consumption have taken off, the growth of imports will outperform that of exports next year, he said.

Besides slackened demand, trade barriers and protectionism will also challenge Chinese exporters, analysts said.

Many exporters, such as Sinologry, which targets European and North American markets, have struggled as the impact of the financial crisis materialized last year.

This year, more than 100 trade remedy cases concerning more than $10 billion were initiated against China.

The latest case was the EU on Tuesday deciding to prolong an anti-dumping tariff on shoe imports from China for 15 months, disregarding strong opposition from several European nations.

Analysts said that as China's trade partners, such as the US, become more export-driven to revive their economies, China will continue to be a major target of trade protectionist measures worldwide.

"Most of those cases violated WTO rules," said Zhou Shijian, a senior WTO expert.

More measures against high value-added categories outside manufacturing, such as a carbon tariff, will show up next year, Chen said.

Chen vowed China will step up efforts to fight trade protectionism.