Top Biz News

Equities edge up led by commodities, banks

(China Daily/Agencies)

Updated: 2009-12-30 08:05

|

Large Medium Small |

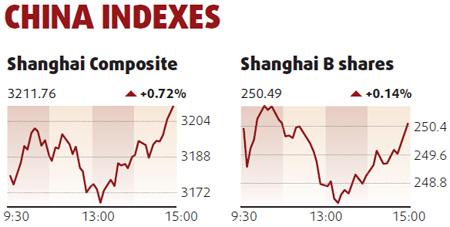

Mainland stocks rose to the highest in two weeks, erasing earlier losses, as commodity producers and banks advanced on speculation the nation's economic growth will boost demand for raw materials and loans.

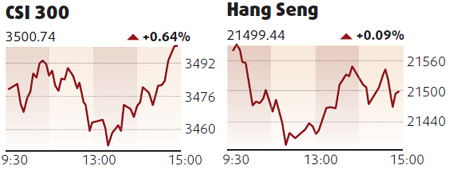

The Shanghai Composite Index rose 22.98, or 0.7 percent, to close at 3211.76, the highest since Dec 16. The CSI 300 Index gained 0.6 percent to 3500.74.

"Growth isn't a problem for China next year," said Yan Ji, who helps oversee about $1.2 billion at HSBC Jintrust Fund Management Co in Shanghai. "Liquidity will still be adequate for the economy and the capital markets, as the government sticks to a loose monetary policy."

The index has rallied 76 percent this year as government spending and a credit boom helped the nation's economy recover from its steepest slump in more than a decade.

PetroChina, the nation's biggest oil company, rose 1.1 percent to 13.55 yuan. Sinopec, the second largest, added 1.3 percent to 13.71 yuan.

| ||||

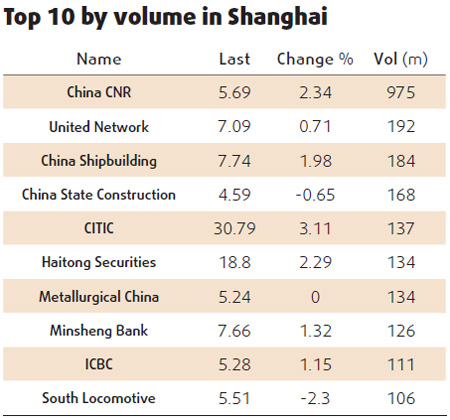

Bank of China, the nation's third largest lender, gained 1.7 percent to 4.23 yuan. Industrial and Commercial Bank of China Ltd, the biggest, added 1.2 percent to 5.28 yuan.

China CNR added 2.3 percent from its offer price to 5.69 yuan in Shanghai, the smallest first-day trading gain in the country this year.

Hang Seng advances

Hong Kong stocks rose, led by developers, after Morgan Stanley said the city's land sale falling short of estimates on Monday "should not be interpreted as a negative market signal".

Sino Land Co, a winning bidder in Monday's auction, rose 0.5 percent. Sun Hung Kai Properties Ltd, the city's biggest developer, surged 1.6 percent.

The Hang Seng Index gained 0.1 percent to close at 21499.44. The Hang Seng China Enterprises Index slipped 0.2 percent to 12644.93.