Top Biz News

Shares soar led by automakers, shippers

(China Daily/Agencies)

Updated: 2010-01-13 08:09

|

Large Medium Small |

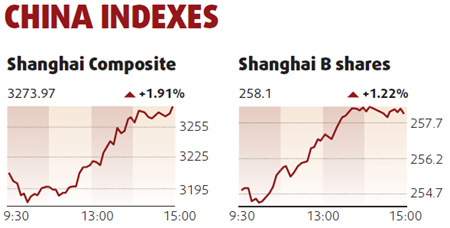

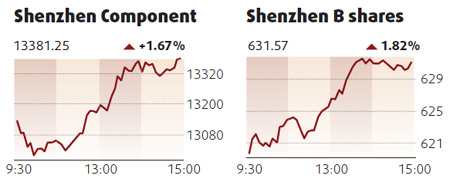

Mainland stocks rose by the most in more than two weeks, led by automakers after the nation's vehicle sales surged the most in at least 10 years, and shipping lines on higher freight rates.

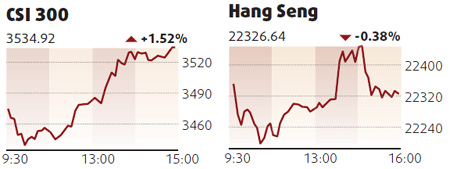

The Shanghai Composite Index rose 61.22, or 1.9 percent, to 3273.97, the most since Dec 24 and erasing an earlier 1 percent loss. The CSI 300 Index gained 1.5 percent to 3534.92.

"China has become the biggest driver for the world's economic recovery now," said Prapas Tonpibulsak, chief investment officer at Ayudhya Fund Management Plc in Bangkok, which manages about $2 billion of assets. "The government's increased spending on infrastructure would help accelerate growth this year."

"The economic recovery is going on and corporate earnings are improving, but the expectation about policy tightening from the government will limit gains on equities," said Zhao Zifeng, who helps oversee about $10.2 billion at China International Fund Management Co in Shanghai.

SAIC Motor Corp climbed 3.5 percent to 23.16 yuan and Chongqing Changan Automobile Co added 2 percent to 13.49 yuan.

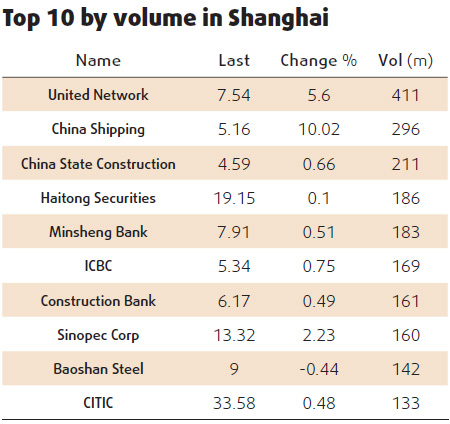

China COSCO Holdings Co, the world's largest operator of dry-bulk ships, advanced the most in three months. Shanghai International Port (Group) Co climbed 5 percent to 5.92 yuan as JPMorgan Chase & Co predicted first quarter container volume will gain.

Hang Seng falls

|

||||

Industrial and Commercial Bank of China Ltd slid 2.2 percent to HK$6.15.

The Hang Seng Index slid 0.4 percent to close at 22326.64, after climbing as much as 0.3 percent. The Hang Seng China Enterprises Index dropped 1.2 percent to 12967.37.