Top Biz News

Financial companies lead fall in equities

(China Daily/Agencies)

Updated: 2010-01-14 07:57

|

Large Medium Small |

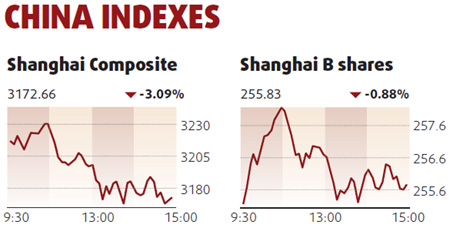

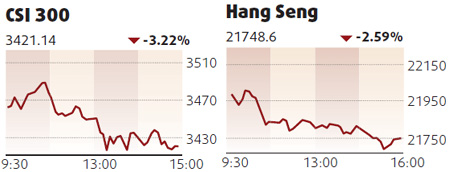

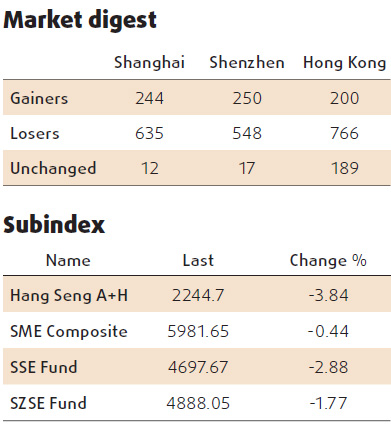

China's stocks declined the most in seven weeks, led by financial companies and commodity producers, after an unexpected shift by the central bank to restrain lending spurred concern that higher interest rates will follow.

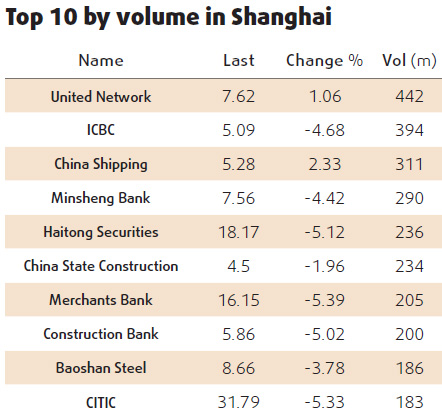

Industrial & Commercial Bank of China dropped 4.7 percent to 5.09 yuan, the most since October 2008. Poly Real Estate Group Co slumped 4.1 percent to 20.43 yuan. The central bank raised the proportion of deposits that banks must set aside as reserves by 50 basis points starting Jan 18.

Jiangxi Copper Co dropped 5.6 percent to 38.02 yuan on concern tighter credit will sap demand for commodities.

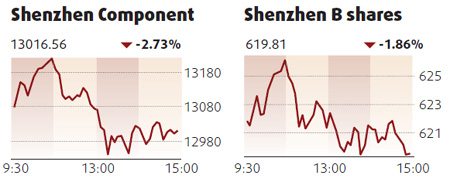

The Shanghai Composite Index lost 101.31, or 3.09 percent, to close at 3172.66. That's the most since Nov 26, when concern that banks would increase share sales drove the gauge 3.6 percent lower. The index has dropped 3.2 percent this year, after rallying 80 percent in 2009 on government stimulus and record bank lending.

An index tracking 50 financial companies on the CSI 300 tumbled 5 percent, its biggest loss since Aug 31.

China's stocks will underperform their regional rivals and investors should underweight shares on the prospect of higher interest rates, according to Emil Wolter, Singapore-based head of Asian Regional Strategy at ABN Amro Bank NV.

The Shanghai Composite "looks expensive", Wolter said.

Brokerages declined as the number of new stock trading accounts slowed for a sixth consecutive week. Investors opened 235,778 trading accounts for the week ended Jan 8, according to the China Securities Depository and Clearing Corp. That's the lowest level for a five-day week since the period to Feb 6.

CITIC Securities fell 5.3 percent to 31.79 yuan even after saying in a preliminary earnings statement its 2009 net income rose 23 percent.

Hang Seng falls

Hong Kong stocks fell, dragging the benchmark index to its biggest drop in more than six weeks.

Aluminum Corp of China Ltd slumped 7 percent to HK$9.65. China CITIC Bank plunged 6.6 percent to HK$5.71, leading a drop in bank shares. China Overseas Land & Investment Ltd fell 4.7 percent to HK$15.7.

The Hang Seng Index slid 2.59 percent to close at 21748.6, its sharpest drop since Nov 27. The Hang Seng China Enterprises Index dipped 3.7 percent to 12482.18.