Top Biz News

Copper prices peak as demand soars

(China Daily/Agencies)

Updated: 2010-01-15 08:08

|

Large Medium Small |

Copper gained on optimism demand will grow even as China moves to curb record lending that helped prices to more than double last year. Aluminum also advanced.

The metal for immediate delivery in Changjiang, Shanghai's biggest cash market, traded at more than 60,000 yuan a ton last week, levels not seen since September 2008.

"Demand is quite robust at the moment as it usually tends to be before the Lunar New Year," said Shenzhen Rongtuo Trading Co analyst Cheng Xiongfei. The vacation, which starts on Feb 14 and lasts a week, precedes the peak-demand season.

Copper for delivery in three months on the London Metal Exchange advanced as much as 0.7 percent to $7,540 a ton, and traded at $7,508.25 in Singapore. March-delivery copper on the Comex division of the New York Mercantile Exchange rose as much as 1 percent to $3.4345 a pound.

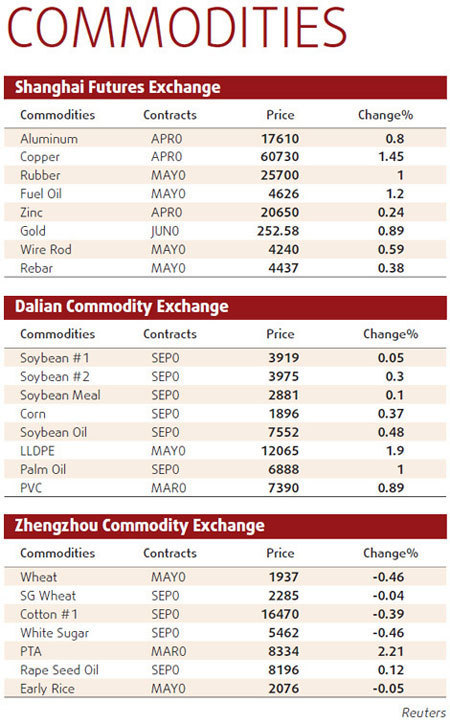

The April contract on the Shanghai Futures Exchange added as much as 2.5 percent to 61,240 yuan, and ended at 60,750 yuan.

"Although the market is still in contango, spot prices and premiums have been improving," said Shenzhen Rongtuo's Cheng.

Commodity markets often trade in contango, with later-dated contracts priced higher than near-month deliveries.

Premiums paid by Chinese importers, an indicator of demand, rose to about $80 to $110 a ton more than the London Metal Exchange cash price last week, up from $60 to $70 last month, according to traders and analysts.

| ||||

Cochilco, Chile's state copper statistics agency, forecast that prices may average $3.1 a pound ($6,836 a ton) in 2010 compared with a previous estimate of $2.70 as a fall in supplies outweighs a slowdown in demand.

Global demand may fall by 0.6 percent to 17.8 million tons in 2010, while global production will fall by 104,000 tons, said Cochilco's research director Ana Isabel Zuniga. Chile is the world's largest copper producer.

Three-month aluminum on the LME rose as much as 1.3 percent to $2,324 a ton, extending Wednesday's 0.6 percent gain.