Top Biz News

Returning Chinese 'orphan' stocks offer opportunities

(China Daily/Agencies)

Updated: 2010-01-18 08:04

|

Large Medium Small |

Chinese "orphan" stocks - companies once lured to float overseas but now left neglected - are starting to head home, creating investment opportunities, said the head of money manager Martin Currie's China business.

Martin Currie, which owns shares in Singapore-listed leasing firm Financial One Corp and London-traded medical device maker China Medical System Holdings Ltd, is betting that if such companies de-list themselves and then float on the Chinese mainland, Hong Kong or Taiwan, their share prices will jump.

Faced with a regulatory environment that long favored large State-owned companies as well as slow approval processes, many smaller private firms chose to list overseas, especially in the first half of the past decade.

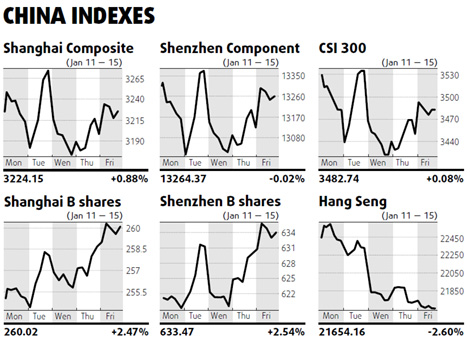

That is now changing, as the government is making fundraising easier for private companies, including the establishment of a NASDAQ-style second board in Shenzhen called the ChiNext.

"In the previous poor market, when listing was very difficult in China, quite a few Chinese companies went abroad and now... we're starting to see companies come back," Chris Ruffle said.

Such a migration, which involves de-listing and re-listing, may take as long as three years, Ruffle said. "But there's quite some upside for patient investors there," he added.

Edinburgh-based Martin Currie's strategy underscores the growing weight of China in global finance, as investors seek higher returns in a region that was less affected by the financial crisis than some western economies.

Taking advantage of ample liquidity and higher valuations on exchanges in China, Shanghai-based biscuit maker Want Want Holdings Ltd de-listed itself from Singapore and re-listed in Hong Kong in 2008, before floating shares last year in Taiwan in the form of depositary receipts.

Want Want, a household name in China, attracted little attention when it was listed in Singapore and traded at low multiples, Ruffle said.

Returning to float on local exchanges is a good move for Chinese firms, Ruffle said: "Each time they've done that, they got a premium on the valuation of the stock."

Martin Currie operates in China via a joint venture with Heartland Capital Management Ltd, called MC China Ltd.