Top Biz News

Insurers post robust returns in 2009

By Hu Yuanyuan (China Daily)

Updated: 2010-01-22 07:56

|

Large Medium Small |

Judge risks before making real estate investments, says CIRC

The investment yield of insurance companies rose by 4.5 percentage points to 6.41 percent last year, with total gains peaking at 21.4 billion yuan ($3.13 billion), the industry regulator said yesterday.

The benchmark Shanghai Composite Index surged nearly 80 percent in 2009 and considerably boosted the value of insurers' stock holdings.

"We will further open up the investment channels by encouraging insurers to invest in the real estate sector," said Wu Dingfu, chairman of the China Insurance Regulatory Commission (CIRC).

He said the regulator would soon launch detailed regulations for insurers planning realty investments.

"Considering the potential risks, insurers would not be allowed to invest in residential buildings or be involved during the property development stage," said Wu.

"At the same time they would not be allowed to make direct investments in the commercial property sector," he said.

Though the industry watchdog opened this channel after the revised insurance law came into effect from Oct 1 last year, Wu said insurers should invest in the property sector step by step and also focus on risk control mechanisms.

Leading insurers like China Life and Taikang Life Insurance Co are planning to build retirement communities for senior citizens. PICC, the country's largest property and casualty insurer, has expressed interest in setting up economically affordable and low-rent houses.

The regulator's plan to free up more investment channels is seen as a move to offset the investment pressures arising from higher premium income.

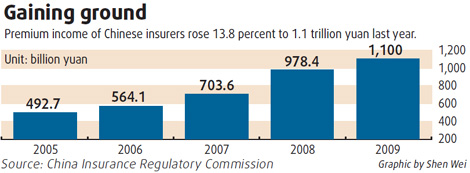

The CIRC statistics show insurers' premium income rose 13.8 percent to 1.1 trillion yuan last year, while their total assets peaked at 4.1 trillion yuan.

"The capital that needs to be invested in bank deposits, bonds and other channels may reach 1.5 trillion yuan this year, thus putting further pressure on insurers," said Wu.

The country's largest reinsurer China Re reported a pretax profit of 5.95 billion yuan for 2009, with investment returns of 5 billion yuan.

"The performance of the industry is better than expected as the business restructuring took effect," Wu said.

To ensure the healthy development of the insurance industry, CIRC last year asked life insurers to slow expansion of investment-oriented products and concentrate on traditional areas. Though the structural adjustment led to a decrease in business scale, it also helped to improve profitability of insurers.