Top Biz News

Metals slump on demand concerns

(China Daily)

Updated: 2010-01-29 08:07

|

Large Medium Small |

Copper headed for its longest losing streak in seven weeks and aluminum dropped to the lowest level in more than a month on concern demand may wane in China and the United States.

Zinc slumped to a two-month low and lead declined to its lowest price in four months. China's banking regulator told lenders to step up scrutiny of property loans, while pledging to satisfy "reasonable" financing needs. In the US, sales of new homes unexpectedly dropped in December, capping the worst year on record.

| ||||

Copper for three-month delivery on the London Metal Exchange dropped as much as 2.6 percent to $7,040.25 a metric ton and traded at $7,090 in afternoon trade in Singapore.

The metal, often used as a gauge of economic activity, is down 3.9 percent this month, headed for its worst January performance since 2007 as China takes action to curb record lending that helped copper prices more than double last year.

March-delivery copper on the Comex division of the New York Mercantile Exchange shed 0.3 percent after slumping 3.5 percent on Wednesday, the most in four months.

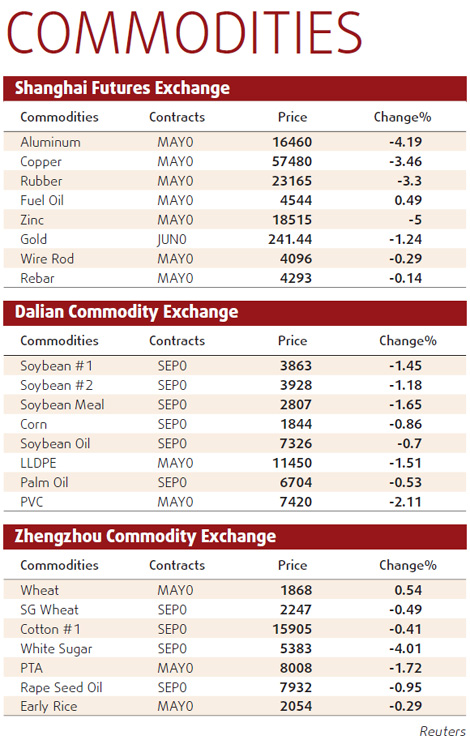

The May-delivery contract on the Shanghai Futures Exchange fell as much as 4.2 percent to 57,050 yuan ($8,357) a ton, the lowest price since Dec 24, before ending the day 3.4 percent lower at 57,480 yuan.

"The curbs on property loans will affect the construction industry and therefore metals," said Zhang. "Investors are now unsure if consumption will be as robust as initially expected come the typically strong demand season in March and April."

Aluminum for three-month delivery dropped as much as 2.4 percent to $2,127 a ton, the lowest level since Dec 9, before trading at $2,145. Zinc slumped as much as 2.8 percent to $2,173.50 a ton, a level not seen since Nov 27, while lead fell as much as 3.8 percent to $2,045 a ton, the lowest price since Sept 14.

Among other LME-traded metals, nickel dropped 1.2 percent to $17,980 a ton and tin added 0.3 percent to $17,900 a ton.