Top Biz News

Strong recovery 'already priced in' by equity traders

By Li Xiang (China Daily)

Updated: 2010-02-01 08:00

|

Large Medium Small |

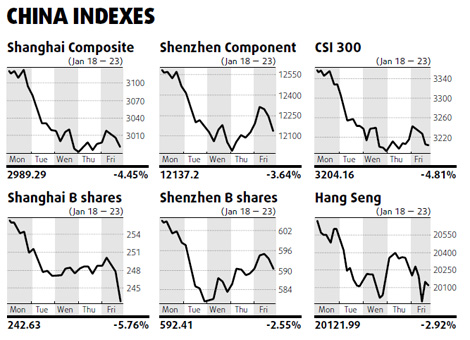

One belief technical traders hold dear is that the market is always right. But the substantial declines in China's A-share market in the past week may suggest that the market sometimes can be wrong, observers said.

The government's aggressive move toward a tightened monetary policy could be misread by most investors who tend to overlook the more important economic fundamentals that project a robust economic growth in 2010, Niu Wenxin, a financial commentator on China Central Television wrote in his blog.

"Investors shouldn't be too worried because the recent declines happened at the beginning of an economic growth cycle rather than a recession cycle," Niu wrote. "It's a time when you can take a short position but you should not stop seeking buying opportunities that may arise."

Shrinking market liquidity is the top concern because of the government's tightened credit policy to rein in excessive bank lending that hit the record high of 9.5 trillion yuan ($1.39 trillion) last year. Fears of an early exit from the stimulus package hampered market performance, which dipped below the psychologically important level of 3,000 points last week to a three-month low.

"What the government is trying to control is the rhythm of bank lending not the actual amount of new loans," Niu wrote. "The excessive credit expansion in 2009 is not going to be sustainable and it must be reduced to a normal level which has been the market consensus."

China's Banking Regulatory Commission has set the new lending cap at 7.5 trillion yuan in 2010. Although the amount is lower than last year, it is still at an unprecedentedly high level.

One thing seems certain: The sweet period of rapid economic recovery with no negative policy response has passed and strong corporate earnings growth will have to compete with the government's tighter monetary policy to combat inflation.

Niu noted that share prices of companies with promising prospects have risen several times while the price to earnings ratio still remained around 20, indicating that the performance of these companies has substantially improved at a fast pace.

"The progress from recovery to solid growth is unlikely to be interrupted but the market may question the sustainability of the economic growth once the government shifts from increasing the banking reserve ratio to interest rates," said Yin Guohong, an analyst at Dongxing Securities. "It means that investors are likely to endure a pretty painful period because the tightened policy will extend the fluctuation period and there won't be any trend opportunities."

Yin noted that the market tends to move downward by penetrating the 250-day moving average before a strong bull trend so it will probably bottom at around 2,800 points. Despite the recent sharp fluctuations, market players remain optimistic about the outlook of China's economic growth in 2010, which appears strong enough to contend with rising interest rates and higher inflation.

"We are positive on China in 2010. Earnings growth will be fuelled by recovering exports, increasing consumer activity and continued government spending," said Jing Ning, manager of BlackRock China Fund.