Markets

Mainland index falls most in five weeks

(China Daily)

Updated: 2010-03-05 09:32

|

Large Medium Small |

SHANGHAI: The mainland's stocks fell the most in five weeks, the steepest decline among global indexes, on concern bank lending may slow and interest rates will rise as inflation accelerates.

Industrial Bank Co dropped 2.4 percent after predicting growth in the bank's new lending will almost halve this year. Poly Real Estate Group Co lost 2.4 percent. Jiangxi Copper Co and Zijin Mining Group Co fell at least 2.7 percent on lower metal prices.

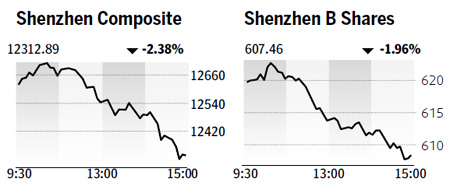

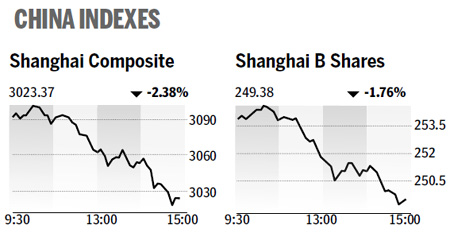

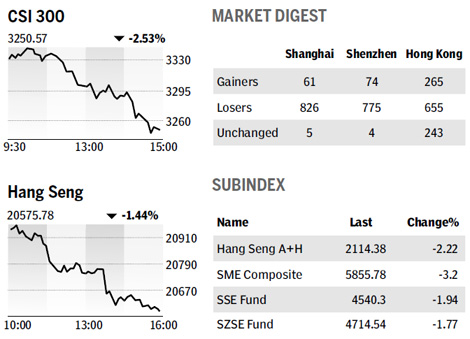

The Shanghai Composite Index dropped 73.63, or 2.4 percent, to 3,023.37 at the close, the biggest decline since Jan 26. The CSI 300 Index fell 2.5 percent to 3,250.57. The Shanghai index declined the most among the 93 worldwide indexes tracked by Bloomberg.

"There's speculation that February inflation was higher than expected," said Wang Zheng, a fund manager at Jingxi Investment Management Co in Shanghai. "The market is worried that the central bank will raise interest rates soon."

China's consumer prices probably rose 2.6 percent in February, compared with 1.5 percent in January, because of the Lunar New Year celebration on Feb 14, according to the median estimate from a Bloomberg survey of 11 economists.

Hong Kong stocks fell on concern China Mobile Ltd will deviate from its main business and as banks fell on speculation price increases in the mainland will lead to higher interest rates.

The Hang Seng Index fell 1.4 percent to close at 20575.78, reversing an earlier gain of 0.6 percent. The Hang Seng China Enterprises Index dropped 2.3 percent to 11775.06.

Bloomberg News