Top Biz News

Gap widens between S&P 500, China's benchmark

By Lu Wang (China Daily/Agencies)

Updated: 2010-03-26 09:31

|

Large Medium Small |

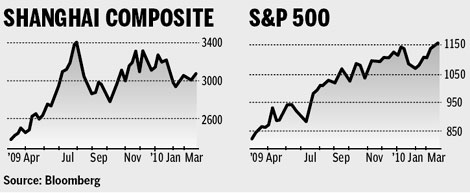

NEW YORK - The Standard & Poor's 500 Index has set new highs while China's benchmark stock index failed to surpass its August peak, a divergence that makes US equities more attractive, according to Janney Montgomery Scott LLC.

Better-than-estimated earnings and record-low interest rates have helped propel the yearlong rally in US stocks, driving the S&P 500 to the highest close since September 2008 this week. By contrast, the Shanghai Composite Index stalled after rising to a 14-month high in August.

The Chinese benchmark had risen more during the first part of the global advance that began in March 2009. That, along with a weaker correlation between the two markets, suggests US stocks will be able to continue their outperformance, said Dan Wantrobski, who studies charts of trading patterns and prices to make forecasts at Janney Montgomery.

"The two markets no longer travel in complete lock-step," the director of technical research at Janney Montgomery wrote in a note. "The US can continue to pull away from the market trends of China and this will continue to boost our relative attractiveness to global competitors."

The relationship between US and Chinese stocks has diminished. The correlation coefficient using 30 days of data between the S&P 500 and Shanghai Composite Index has retreated to 0.09 from 0.48 in December and a record 0.67 in March 2007, according to data compiled by Bloomberg. Readings of 1 indicate markets are moving in the same direction by the same amount. It dropped as low as minus 0.04 in 2009.

|

||||

The advance in China lost momentum as the government stepped up measures to contain inflation. The index has decreased 7.4 percent this year.

The S&P 500 has risen 4.7 percent since Dec 31 as the US economy returned to growth and a record-long slump in earnings ended.