InfoGraphic

Rate increase fails to rein in bull run

By Li Xiang (China Daily)

Updated: 2010-10-21 09:57

|

Large Medium Small |

Stock market hits six-month high following hike in interest rate

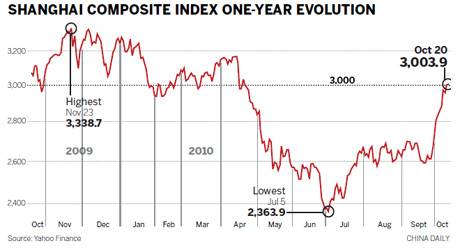

BEIJING - China's benchmark stock index rose to a six-month high on Wednesday, reflecting investor confidence in the strength of the economy following the central bank's interest rate hike.

Analysts said that the rate hike is unlikely to change the bullish trend in the A-share market.

Led by the financial and resource shares, the Shanghai Composite Index rebounded from morning lows to close at 3,003.95. The last time the index stood above the psychologically important threshold of 3,000 was on April 21.

Coal stocks gained 5.16 percent with Datong Coal Industry Co, the country's third-largest coal company by capacity, soaring by the 10-percent daily limit on investor confidence in resilient demand.

Bank shares also advanced on market expectations that the rate increase would improve business prospects by boosting interest margins.

The Shanghai stock index has rebounded 27 percent from July's low level on expectation of a continued inflow of liquidity attracted by the rising yuan.

The People's Bank of China announced on Tuesday night that it would raise benchmark interest rates by 25 basis points on Wednesday, the first increase for nearly three years.

Some economists said the rate hike may mark the onset of a tightening cycle, but others expected its impact on the equities market to be limited.

"The market may not take the move too negatively," economists Helen Qiao and Yu Song with US investment bank Goldman Sachs said in a report.

"After seeing growth rebound from the low levels in the second quarter, investors are less worried about the over-tightening and hard-landing risks in China."

Qiao and Song noted that the rate hike would help tackle inflation, which has already put real interest rates in negative territory.

Property stocks suffered a major blow as investors worried that higher borrowing costs may deter home purchases.

The rate hike "is unlikely to have a major impact on the equities market as economic growth will remain robust for the rest of the year", said Dong Xian'an, chief economist at Industrial Securities.

The surprise move by the central bank sent jitters through some markets while others rose.

In Asia, Japan's Nikkei closed down 1.65 percent, with exporters shaken by fears of slowing Chinese growth. Hong Kong's Hang Seng index slid 0.9 percent to 23,556.50. Stock markets in India, Thailand and Indonesia also registered falls.

However, South Korea's Kospi closed up 0.7 percent to 1,870.44 and markets in Taiwan and Malaysia also saw gains.

European stock markets steadied on Wednesday, and Wall Street opened modestly higher following Tuesday's biggest retreat in two months.

Many market watchers remain bullish about the Chinese economy.

"I will definitely take that (rate hike) as confirmation about the strength of the Chinese economy," said Robert Greifeld, chief executive officer of Nasdaq OMX Group Inc, the world's largest exchange company.

Chen Jia contributed to this story.