China attractive FDI destination

Updated: 2011-08-23 10:06

By Zhou Siyu (China Daily)

|

|||||||||||

A billboard advertising local projects for foreign investors stands high at an industrial exhibition in Shanghai. China remains an attractive destination for foreign direct investment despite the global economic recession. [Photo / China Daily]

Services and high-tech sectors will see biggest inflows of capital from abroad, experts predict

BEIJING - China will remain the most attractive investment destination over the next two years, as world foreign direct investment (FDI) gradually recovers from the global financial downturn, said the United Nations Conference on Trade and Development (UNCTAD) and economists.

As the government continues to push for the country's industrial upgrading and relocation, China's FDI inflows, particularly to sectors such as services and high-technology, will remain bulky in the coming years, they said.

"China boasts a bright future in attracting more FDI flows," said James X. Zhan, director of the investment and enterprise division of UNCTAD.

FDI jumped 18.6 percent year-on-year in the first seven months to $69.2 billion, said the Ministry of Commerce on Tuesday. Foreign investors set up about 15,600 new projects during the first seven months, up nearly 8 percent from the same period of last year.

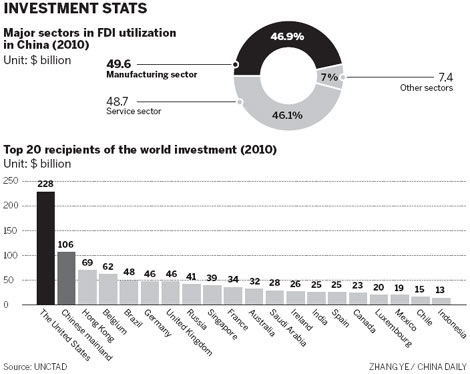

The global FDI volume increased by 5 percent year-on-year to $1.24 trillion by the end of 2010, according to the The World Investment Report 2011, released by UNCTAD last month.

The figure is still 15 percent lower than the average volume of $1.472 trillion before the financial crisis and 37 percent lower than the peak volume of $1.971 trillion reached in 2007, the report said.

Some developing countries with promising economic growth were the major FDI recipients, and nearly half of the investment flowed to new manufacturing projects, according to the report.

In China, FDI inflows registered a stronger recovery. In 2010, FDI in China surged by 17.4 percent from last year to $105.7 billion, the first time the figure exceeded $100 billion, compared with a decline of 2.6 percent year-on-year in 2009, data from the Chinese Ministry of Commerce showed.

According to the ministry, FDI to the service sector jumped by 28.6 percent to $48.7 billion in 2010, accounting for 46.1 percent of China's total figure. The manufacturing sector absorbed $49.6 billion during the same year, up 6 percent year-on-year.

Geographically, the FDI growth rate in Central China registered the most notable increase. In 2010, FDI to Central China surged by 28.6 percent year-on-year to $9.02 billion. West China has seen an increase of 26.9 percent year-on-year while the country's eastern region showed an increase of 15.8 percent from 2009, official data showed.

"The different increases in different regions and sectors are caused by the country's policies to accelerate industrial relocation and upgrade the country's industrial structure," said Hao Hongmei, a researcher at the Chinese Academy of International Trade and Economic Cooperation.

The Chinese government has reiterated its policy to upgrade the country's industrial structure. Rising costs of labor, appreciation of the yuan and several other factors over recent years have put tremendous pressure on the manufacturing sector in China's coastal cities.

As a result, more and more manufacturing businesses in the eastern region are encouraged to move to West and Central China where labor is abundant and the cost is lower.

"The service sector, especially in East China, will benefit from the policy for further development, while Central China has absorbed more FDI with the industrial relocation," said Lian Ping, chief economist at Bank of Communications.

"FDI flows to China's service sector will continue to grow and take an increasingly larger percentage of the overall figure," Lian said.

By contrast, global FDI in the service sector continued to fall sharply in 2010, accounting for 30 percent of the total figure. In manufacturing, FDI volume surged by 23 percent year-on-year in 2010 to $544 billion, according to the investment report by UNCTAD.

"Unlike manufacturing, it may take more time for the service sector to recover from the financial downturn," Hao said.

Still, the global recovery will continue. In 2011, global FDI volume is expected bounce back to between $1.4 trillion to 1.6 trillion. The figure is estimated to rise to $1.7 trillion in 2012 and $1.9 trillion in 2013, the report said.

The road ahead is also fraught with uncertainties. Dangerous factors, such as inflation, economic overheating in developing economies and sovereign debt crises may still hinder the FDI recovery worldwide, Zhan from UNCTAD said.

In China, FDI looks set to reach a new record in 2011 and could exceed last year's $106 billion, according to the Chinese Ministry of Commerce.

During the first half of this year, FDI in China surged by 18.4 percent year-on-year to $60.9 billion. The service sector attracted $28.1 billion, up 21.4 percent from last year, while manufacturing absorbed $28.5 billion, increasing 15.63 percent year-on-year, official data showed.