Capital outflows 'could result in further easing'

Updated: 2011-12-20 09:49

By Li Xiang (China Daily)

|

|||||||||||

BEIJING - China experienced capital outflows for a second consecutive month in November, which could prompt policymakers to further loosen monetary policy and perhaps even return the yuan to being pegged against the US dollar, as it had been in 2008, analysts said on Monday.

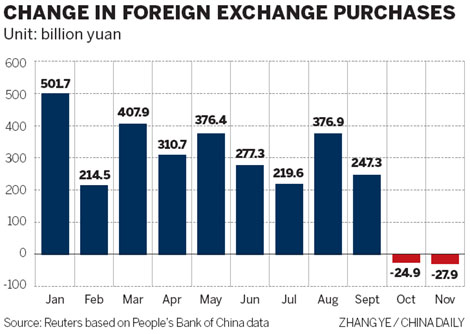

Chinese banks' yuan positions for foreign-exchange purchases fell by 27.9 billion yuan ($4.43 billion) in November amid increasing global economic uncertainties and concern about a domestic economic "hard landing".

The amount of foreign exchange purchased by Chinese banks is usually seen by analysts as a key indicator of cross-border capital flows.

The value of the purchases fell by 24.9 billion yuan in October, the first time in four years that China reported a decrease in foreign-exchange purchases by banks.

The figures could "prompt the central bank to cut the reserve requirement ratio (RRR) again to offset the recent decline of foreign-exchange purchases and capital outflows," Zhang Zhiwei, chief economist for China at Nomura International (Hong Kong) Ltd, told a news briefing in Beijing.

Zhang forecast the People's Bank of China (PBOC), or central bank, would cut the RRR soon by another 50 basis points and loosen requirements for banks' loan-to-deposit ratios to stabilize domestic liquidity.

Zhang said that increasing capital outflows reflected China's shrinking trade surplus and slowing foreign direct investment (FDI) in the short run.

Other factors, according to Zhang, include changes in investors' risk appetites as the sovereign debt crisis in the eurozone deteriorates.

Analysts warned that if the trend of capital outflows continued, China might return to a dollar peg, as it did during the world financial crisis in 2008.

Instead of allowing for the yuan's steady depreciation, the PBOC has set the middle-trading price of the yuan at a persistently high level. The aim is to stabilize the yuan's value against the US dollars as investors sell the currency on expectations that it will further depreciate.

"If such exchange-rate stability fails to change market expectations of a weakening yuan, it will cause more capital outflows and the situation won't ease at least until the first quarter of next year," said Lu Zhengwei, chief economist with Industrial Bank Co Ltd.

Analysts said that the Chinese currency will continue to face depreciation pressure, even though the PBOC has guided the dollar-yuan daily fixing rate higher.

"Capital outflows, together with a narrower trade surplus and slowing FDI, are likely to reduce appreciation expectations and reinforce depreciation expectations, given a weakening global economy and investor sentiment," Chang Jian, Huang Yiping, and Yang Lingxiu, economists with Barclays Capital, wrote in a research note.

Related Stories

Move to ease capital outflow restrictions 2005-01-05 09:06

New policies on capital outflow expected 2004-07-01 08:26

China continues to see capital outflows 2011-12-20 07:20

Worries on capital outflows overdone: Analysts 2010-11-27 07:04

- Emerging markets key to shipping firms

- Oil leak company at odds with environmentalist

- Taobao: attackers are illegal merchandisers

- Economic growth seen slowing down in 2012

- Social funds yields may be negative

- Capital outflows 'could result in further easing'

- Juice maker plans for expansion

- Manufacturing to stay pivotal