Families urged to rethink finances

Updated: 2011-12-26 10:09

By Chen Jia and Hu Yuanyuan (China Daily)

|

|||||||||||

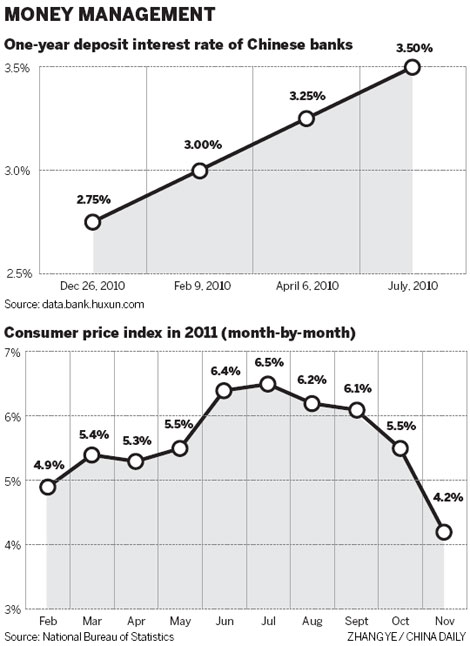

Preserving asset values is priority if inflation surges again in 2012, says economist

BEIJING - Chinese family wealth may grow at a lower pace next year as economic growth slows and risks in global investment markets increase, said analysts.

|

|

|

Because of high inflationary pressure, most Chinese families are expected to try to preserve the existing value of their assets while formulating financial plans for next year.[Photo/China Daily] |

The structure of family asset portfolios will need to be adjusted according to the government's changing policies to achieve a maximum investment return, they said.

A key objective of families' financial plans next year will be to preserve the existing asset values because inflation is expected to continue to threaten investment income, said Zhang Shuguang, an economist with Unirule Institute of Economics, a nongovernmental think tank in Beijing, speaking on Dec 17 at a forum held by China Guangfa Bank Co Ltd.

"Inflation may be a long-term problem in the country because food prices may surge again and the price of manufacturing resources is likely to grow fast in the coming year," he said.

Zhang suggested families should invest more in physical assets, including precious metals, real estate and antiques to avoid the deleterious effects of currency devaluation.

According to a report that was jointly released earlier this month by the China Center for Financial Research (CCFR) at Tsinghua University and Citi Foundation, people's awareness of managing family finances has been strengthened in line with their increasing annual income.

The average after-tax income for Chinese urban households totaled 89,170 yuan ($13,933) in 2010, compared with 50,997 yuan in 2009. The average value of assets for each family was 715,947 yuan last year, an increase on 406,536 yuan in 2009, the report said.

"Among urban families with average annual personal income between 50,000 yuan and 100,000 yuan, 63.7 percent have family wealth management plans this year, compared with 27.5 percent last year," said Zhang Jinbao, a researcher with CCFR.

The report, covering 5,800 families in 24 cities, said that families would prefer holding bank deposits and cash rather than equities, funds, insurance and government bonds, and tended to choose investment products with relatively lower risks.

Zhang said that about 22 percent of the surveyed families hold stocks, while 17.39 percent hold funds. Real estate is still regarded as the most important asset for Chinese families.

However, because of the effect of tightening measures, the nation's property market continued to cool with 70 percent of 70 major cities showing month-on-month price falls in November, according to the National Bureau of Statistics.

Shui Pi, editor-in-chief of Beijing-based China Times, who is also a financial commentator, said that real estate prices are likely to further drop in 2012, which will shrink the total asset value of most Chinese families.

The CCFR report showed that despite the government's rigorous measures, 58.67 percent of home-owning families still expect a slight rise in property prices, while only 5.94 percent of them expect a slight drop.

Shui said that blue-chip shares may be the stars next year. He plans to increase his investments in the stock markets "because the Shanghai Composite Index has almost reached the lowest point of about 2200, which means a rebound is coming soon".

Huang Junjie, deputy general manager of the Personal Banking Department with China Guangfa Bank, suggested that 70 percent of families' investments should be injected into fixed-income products, such as property, "while the other 30 percent is for short-term investment with higher liquidity, such as stocks", he said.

Besides regular investments, the report from CCFR also showed that 24 percent of surveyed families save money to cover medical care and deal with emergencies, followed by 22 percent for children's education and 19 percent for pensions.

Chen Keyu contributed to this story.

Related Stories

Fosun to invest billions as it goes for global expansion 2010-12-09 11:15

A family that thawed cold war ice 2010-12-07 09:18

Murdoch's $29m investment in Xunlei may pay off 2011-06-16 17:19

ABC's 'Modern Family' is big winner with DVRs 2011-10-19 11:29

- Bank reserves 'may be cut again next year'

- Surplus revenue is a taxing problem

- Provincial borrowers defer loan payments

- City to aid in Foxconn's recruiting

- China, Pakistan ink currency swap deal

- Families urged to rethink finances

- Furniture retailer fined after 'fake imports' scandal

- China's publishing companies urged to go global