Experts call for easing monetary policy

By Chen Jia (China Daily) Updated: 2012-06-06 09:10Annual growth in broad money supply, which is know as M2, is likely to decrease to 12 percent in May, lower than the government's target of 14 percent, indicating that lower market liquidity may pull the economy deeper into the doldrums, said Xu.

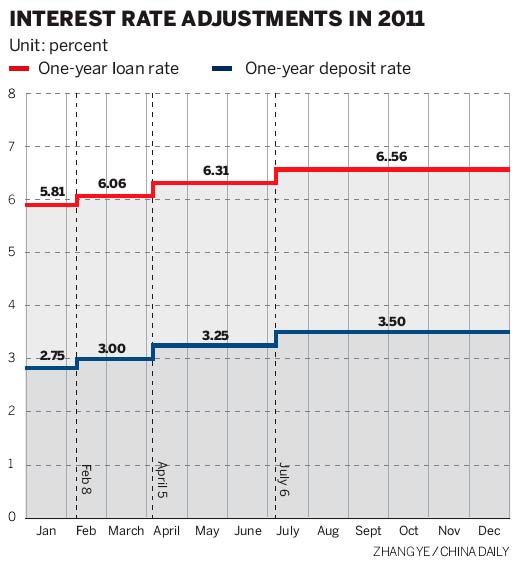

"Now it is the best time to accelerate interest rate liberalization, cutting the loan rate while keeping the deposit rate at the current level, which means that commercial bank interest margin should be narrowed," according to Xu.

Earlier this year, Premier Wen Jiabao vowed to rein in banks' profits and break the major lenders' domination of the market by promoting financial reform.

Xu predicted that last month's consumer price index, a main gauge of inflation, may show a reading of 3.1 percent, declining from the April's 3.3 percent and March's 3.6 percent, because of easing food prices.

"By the end of June, the central bank may cut benchmark interest rates by 0.25 percentage points as well as cut the RRR by 0.5 percentage points," said Liu Ligang, head of China economics at Australia and New Zealand Banking Group Ltd.

He said that another reduction in the RRR by 100 basis points may occur in the second half as inflationary pressures may continue to ease, leaving space for further policy easing.

Besides this, boosting investment in infrastructure projects could be a very effective way to stabilize short-term economic growth, said Ba.

chenjia1@chinadaily.com.cn

- Companies resume trading as stocks rebound for third day

- China sees exports increase 2% in June, imports decline

- Lock-up shares worth 18.2b yuan eligible for trade

- Intercity rail line links Beijing, Jixian county

- Let's focus more on the fundamentals of Chinese economy

- Beijing considers congestion charging to alleviate traffic ills

- Changes needed to halt declining auto exports

- Premium carmakers vow greater support for dealers