Tough conditions for new offerings could benefit secondary market, analysts say

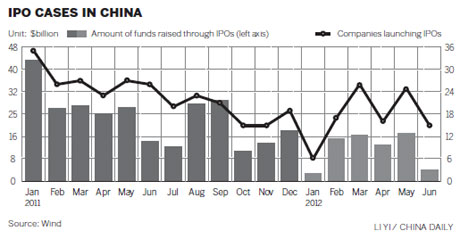

Chinese IPO financing in the first half of this year is set to dip to a three-year low, due to a shortage of funds and few large companies going public.

But experts think this will benefit the secondary market to some extent.

As of Monday, the amount of equity financing in the mainland A-share market totaled 186.6 billion yuan ($29.36 billion), of which 68.7 billion yuan came from 103 companies' IPO financing, according to Wind Information Co Ltd.

IPO financing reached 160.7 billion yuan in the first half of last year, and 212.8 billion yuan in the same period of 2010.

The average price-earnings ratio of IPOs was 31 by Monday, while it was 46 in the first half of last year, and 59 in the first half of 2010.

"The shortage of funds can explain why IPO financing activity in China this year is not positive," said Hong Hao, managing director and chief strategist at BOCOM International Holdings Co Ltd, the international investment banking and securities arm of Bank of Communications Co Ltd.

Hong told China Daily that retail investors are the main part of the A-share market, but their funds are trapped in the market.

Institutional investors such as public offering funds also do not have much new capital that can be invested in the stock market.

"As the primary and secondary markets have a competitive relationship, the difficult condition of IPO financing in the primary market is good for the development of the secondary market," Hong added.

Hong said that when the IPO process was suspended by the China Securities Regulatory Commission at the end of 2008, the Shanghai Composite Index was about 1,600. At the beginning of July 2009, when the IPO process was restarted, the index rose to more than 3,400.

Although IPO financing declined in the first half of this year, the number of companies applying for IPOs continued to increase.

According to the CSRC website, 704 companies had been under or passed examination by June 15, up 189 from Feb 1, when the CSRC first disclosed its list of companies under or passing examinations for IPOs.

Citic Heavy Industries Co Ltd has started its IPO process with a target of raising 4.1 billion yuan. It is expected to be the largest IPO deal in the A-share market so far this year, according to China Securities Journal.

According to the newspaper, 75 companies have issued corporate debt, and their financing funds totaled 88.2 billion yuan, increasing 71.5 percent year-on-year.

"Corporate bonds can be of great potential. Not only companies would like to sell them when the prices of their stocks are low, the public are also fond of buying them because they are have lower risks and favorable returns," said a managing director at a securities company.

caixiao@chinadaily.com.cn