British fashion brand Karen Millen has launched on the Chinese mainland with a first store in Beijing, another expected next year in Shanghai, and a plan to open a chain of 60 stores across the country within the next five years.

Promising to bring consumers quality at very affordable prices, the company's Managing Director Gemma Metheringham said there is a very clear gap in the local market for the type of items sold by the growing retailer, priced at a range between luxury names such as Louis Vuitton and Dior, and regular high street brands.

She is also very clear about her typical customer: a "strong, confident" woman in her 20s to 40s, living in a cosmopolitan city.

"She's not frightened to stand out. She appreciates great quality, wants to treat herself, is a clever consumer, and she wants something beautiful," Metheringham said.

Located in Beijing's Chaoyang district, the launch store covers about 300 square meters, and its opening collection includes around 190 items of clothing and 50 accessories.

"We're very excited to enter the Chinese market, and believe our position of attainable luxury will work well with customers," said Metheringham, who was originally hired by the chain's founder Karen Millen and her then husband and co-founder of the brand, Kevin Stanford, as design director in 1999.

China has experienced an influx of luxury brands, with the likes of Louis Vuitton, Dior and Hermes charging retail prices 30 80 percent higher in China than at home, according to research by consultancy Labbrand.

At the same time, high street names such as Zara, H&M and Topshop have also been in competition to woo Chinese shoppers with more affordable products.

But Metheringham sees a gap between the two in the Chinese market, which she believes her brand can fill.

"Luxury brands are so expensive, that it requires a serious decision to make a purchase. Karen Millen sits as something with nice quality, but also affordability to more people.

"Our ethos is about creating pieces you will treasure," she explained.

Even so, Karen Millen will also be fighting head to head against key international competitors, including Michael Kors, Tory Burch and Ted Baker, all of which have recently opened stores in China.

Metheringham said she has set Karen Millen's prices at a slight advantage over other brands in its sector.

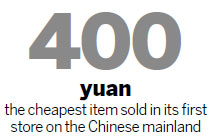

Its home collection, for instance, has a price range of between 35 pounds ($56.43) and 1,200 pounds, while its China collection is priced between 400 yuan ($64) and 20,000 yuan. Import duties mainly account for the difference, she said.

The new China operation is a wholly owned subsidiary.

Although design will be carried out at its headquarters in the UK, Metheringham said local tastes will be incorporated as much as possible into the ranges sold locally.

She said the company is currently working on a new collection of dresses for the Chinese Lunar New Year in spring 2013.

The brand's links with China are already strong, with manufacturing split equally between there and Europe. Items manufactured in China mostly involve embroidery work.

The company plans to open a store next in Shanghai in the spring, and an additional 60 stores across China over the next five years, either as wholly owned subsidiaries and franchises.

"The advantage of operating as a wholly owned subsidiary is the ability to get information from the consumer directly.

"You can also better protect the way your brand is presented. But the franchising model could offer greater local knowledge," she explained.

Karen Millen opened in Hong Kong in October 2008, and now has three stores there, with a fourth to come in March.

Since its launch in 1981, Karen Millen has grown to more than 350 stores and concessions in more than 50 countries and regions. International sales account for over 60 percent of turnover.

Lu Moudu, a partner at Adfaith Management Consulting Inc, said non-luxury international apparel brands such as Karen Millen can find it hard to compete with local brands in a market where industry growth is clouded by the weak economy and surprisingly high clothing inventories.

He added that such "bridge" brands, between luxury and high street, can also prove challenging, given the polarized nature of the local industry.

China's clothing industry slowed in the first half of 2012, due to a shrinking international market and rising raw material costs, according to the China National Garment Association.

The sales growth of major apparel retailers has also suffered a six-month consecutive decline, down 6.5 percentage points year-on-year.

Contact the writers at cecily.liu@chinadaily.com.cn and wangzhuoqiong@chinadaily.com.cn