China's cheese market is booming as more diners in the nation take their first bite of this still relative newcomer to their plates, offering golden opportunities to cheese producers across the globe.

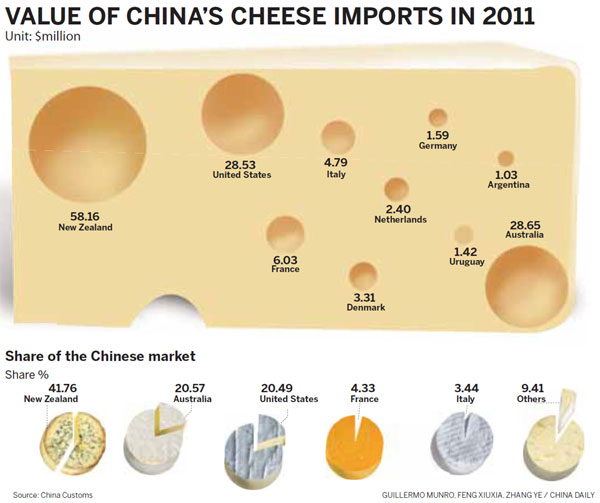

The nation's cheese imports totaled $139.26 million in 2011, up from $105.45 million in the previous year, and $69.77 million in 2009, according to the Italian Trade Commission.

"Both foreign producers and domestic dairy giants are sending positive signals. More foreign brands want to come in, and sales in China are growing rather fast," said Han Jin, general manager of Shanghai Roria Trading Co, a local distributor of imported food.

Han's company sold 40 metric tons of imported cheese in 2009, and the figure rocketed to around 100 tons in 2011.

Entrepinares SAU from Spain and Parmalat SpA from Italy, both dairy giants in their own countries and globally, have been cooperating with Roria.

Parmalat saw its annual sales in China increase by more than 100 percent in the past year.

"The nation's consumption of cheese is growing at a stunning speed," he said.

Before 2008, all that Han knew about cheese was sweet-flavored milk extract produced in the Inner Mongolia autonomous region.

That is why he almost vomited when he had his first bite of Parmesan cheese from Italy. But he soon found the taste very attractive.

And with the rapid expansion of fast-food chains such as Pizza Hut and McDonald's, most people have tasted cheese, and can accept it. In addition, with more bars, cafes, bakeries, and high-class restaurants and hotels opening in China, more people are adapting their palates to Western tastes.

Leo Liu, a cheese trader who runs an online store on Taobao.com, China's biggest e-commerce website, said mozzarella and cream cheese from New Zealand are his bestsellers. He sold almost 3,000 packs of mozzarella last month, priced at 20 yuan ($3) a pack.

"Young people are buying cheese to cook pizza at home. It is not expensive, and gives a feeling of a Westernized lifestyle, which is chic," he said.

Ji Haiyan, a senior account manager with Foodgears (Shanghai) Trading Co Ltd, said there were more important reasons for Chinese people to purchase imported cheese.

"People are concerned about food safety, especially dairy products, after the melamine scandal," she said.

Melamine-tainted milk killed six infants and left more than 290,000 others with kidney damage in 2008, making the whole country question the quality of domestically produced dairy products. After a decline in sales and more efforts in quality control, the cost of milk has surged.

Considering the appreciation of the yuan, improving living standards, and the rising cost of milk, as well as people's concerns about food safety, now is definitely a good time for foreign cheese producers.

Simone Ficarelli, head of international activities at Italy's Parmigiano Reggiano Cheese Association, said it has been working since 2003 to promote cheese in China, and the region's Parmesan cheese is now available in many supermarkets, restaurants and hotels in the nation.

"Cheese itself is a really new product in China. We know it takes time to get established here," he said on the sidelines of FHC China 2012, a trade show recently held in Shanghai.

After years of patient work, some players have already made considerable profits in China. The Italian Trade Commission said the value of Italian cheese exports to China had doubled to $4.79 million from 2009.

And their competitors from New Zealand saw sales surpass $58 million last year, with the nation holding a 41 percent share of China's cheese market.

According to a report by food and drink consultancy Zenith International in 2009, consumption of cheese accounts for just 4 percent of China's dairy products market, which points to the huge potential for the industry.

"The Chinese market has a big potential when it comes to cheese, as consumption levels are relatively low," said Theis Brogger, a spokesman for Arla Foods, a Swedo-Danish dairy cooperative based in Denmark, and the largest producer of dairy products in Scandinavia.

Brogger's outlook for the Chinese market was shared by Stephen Jones, managing director of British cheese exporter Somerdale.

"At the moment, our exports to China are quite small, about 50,000 pounds per year ($80,250) compared with 20 million pounds to all other export markets, but we expect this will grow in the next five years," he said.

But competition will be fierce.

Although Chinese dairy giants, such as Mengniu, Yili and Bright Dairy, have all introduced cheese products in recent years, none has acquired a dominant position yet.

New Zealand, Australia and the United States, the top three biggest cheese exporters to China have already taken more than 80 percent of the market, thanks to strong promotional activities and competitive prices, so latecomers should find their niche as soon as possible, said Han, the local distributor.

Brogger said that European brands' expertise in food quality control is a natural advantage compared with Chinese competitors, especially as food safety is currently a concern in China.

"Our quality control systems from farm to product are very relevant for the Chinese market, where consumers are looking for safe and healthy products. We are focusing on natural and healthy products and therefore there are only natural ingredients in our products," he said.

Arla had to make adjustments to its cheese flavors to suit the taste of Chinese consumers, who prefer sweeter and less salty products, he said.

After testing a variety of cheese flavors in China, Somerdale found that Chinese consumers have a special preference for its fruit cheeses, such as mango and ginger or cranberry, said Jones.

In a bid to seize the opportunities in the Chinese market, UK Environment Secretary Owen Paterson led a food trade delegation to FHC China 2012.

"From chocolate to cheddar, China's population is getting a taste for dairy, and Britain's world-class food industry can supply that demand," Paterson said.

The United Kingdom has room to significantly expand production while other European Union countries are restricted by milk quotas until 2015, he said.

"I believe there are great opportunities here," said Jones from Somerdale, who said the company is looking to increase the number of its distributors in China.

He said that the company's major customers were foreign residents in China, as well as younger Chinese people who had studied in Western countries.

Jones earlier told the BBC that expanding in China is complicated by a number of regulatory hurdles, but added that the effort was justified by demand for the product.

"Compared to US cheddar, which is young, maybe only a week old, our cheese is much older. Some are a year old, and have more flavor," Jones said.

"They've been here longer, but we will catch up," he said.

Contact the writers at xieyu@chinadaily.com.cn and cecily.liu@mail.chinadailyuk.com