'Top-tier' cities facing congestion, rising rates of vehicle ownership

|

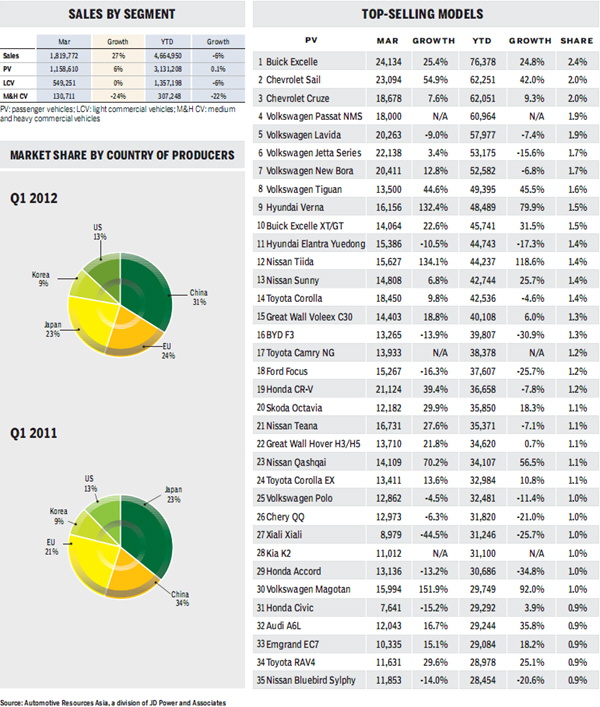

Through the first quarter, passenger vehicle sales only grew 2 percent to 3.4 million units as light commercial vehicles saw a 6 percent decline year-on-year to 1.4 million units.

The March figures put projected sales for the year - known as the seasonally adjusted annual rate - at 18 million units, down 16 percent from the 21.4 million units projected in February.

In the first quarter, the rate averaged 18.6 million units, compared to 18.7 million units in fourth quarter of 2011 and 18.6 million units in the first quarter of 2011.

We believe that the 2011 first quarter figure included some volume pushed through from the last quarter of 2010, which made the first quarter of 2012 look weaker than it actually was.

Yet it does appear that the market has slowed.

Market fluctuations, whether up or down, impact segments at different rates. When the market slows, it is the mini-car segment that is first to weaken, then the sub-compact, compact and so on up through the size segments. This is also true for a strengthening market, when again the smallest segment responds fastest.

In the first quarter, mini-car sales plummeted 29 percent year-on-year, followed by the sub-compact segment, which was down 10 percent. Buyers of economy cars are hit harder in a downward economy than those in the upper segments. This is the reason why local brands usually earn market share in a booming market and lose it in a moderate one.

The luxury segment is usually the last to be hit. In the first quarter, luxury car sales increased 22 percent compared to the same period last year. If you combine in luxury SUVs, the segment surged 33 percent. But it should be noted that the incentives provided in the luxury vehicle market have increased compared to the fourth quarter of 2011.

The luxury brands are opting to sacrifice some profit to gain buyers who typically shop in the midsize segment. This has enabled them to maintain double-digit growth in a weak market.

The retail price of some entry-level luxury cars is now even lower than midsize cars such as the Accord, Camry and Passat. We expect the growth of luxury vehicles to moderate in the coming months because we assume these levels of incentives are not sustainable.

The SUV segment grew 20 percent year on year, driven largely by midsize and luxury SUVs. The majority of the segment, compact SUVs, only realized 10 percent growth. The number of local branded SUVs has mushroomed in the compact SUV segment, despite already-fierce competition.

Following demand

As the market weakened, most automakers turned their attention to smaller cities that have showed solid demand in recent times.

The emerging markets have lower urbanization rates, lower vehicle penetration rates, higher populations, greater land areas and larger overall GDPs than many developed areas. Their rate of motorization is similar to bigger cities five years ago.

It is believed that demand for new vehicles will slow in developed markets after car density reaches a certain level and as second-hand vehicle sales rise to take over part of the demand for low-end vehicles. Constraints on road construction and traffic conditions will also limit growth in these areas.

These regional dynamics require careful planning by carmakers when building their product portfolios and designing their marketing plans.

That is why manufacturers choose to keep previous generations of vehicles when launching new ones - the different models meet different demands in different areas. Shanghai GM is renowned for adopting unique marketing strategies for the different markets in China.

Overall, given the low penetration rates around the majority of the country, we still believe demand will remain strong.

Considering sales from May to August in 2011 were affected by the earthquake in Japan, year-on-year growth is expected reach double digits in the second quarter. Our 2012 light vehicle forecast remains unchanged at 14.3 million units, up 8 percent from 2011.

The author is a senior analyst at LMC Automotive . She can be reached at JGu@LMC-auto.com

|

|

Delicate but grueling work

Delicate but grueling work

Luxury autos debut in Chengdu motor show

Luxury autos debut in Chengdu motor show

2014 Shenyang Faku Intl Flight Convention kicks off

2014 Shenyang Faku Intl Flight Convention kicks off

Hongyuan Airport opens in Sichuan

Hongyuan Airport opens in Sichuan

Top 10 countries with most gold reserve

Top 10 countries with most gold reserve

Top 10 most expensive restaurants in Beijing

Top 10 most expensive restaurants in Beijing

China Internet Conference kicks off in Beijing

China Internet Conference kicks off in Beijing

Top 9 food safety scandals served by global brands

Top 9 food safety scandals served by global brands