China's inflation drops to 2.1% in March

|

|

Wang also said he believes the prudent monetary policy is the appropriate choice for China at this time, arguing that the present macroeconomic policy can ensure that the country realizes its economic growth target of 7.5 percent.

"As China is experiencing a sound employment rate and a normal level of inflation at present, maintaining the current intensity of the current policies is advisable," Wang said.

He did not rule out the possibility of policy changes in the event that economic growth shifts at a relatively fast pace.

The NBS is scheduled to release GDP data for the first quarter on April 15.

Wang said inflationary pressure may ramp up in the latter half of the year, partly because the CPI remained at a low level in the latter half of 2012, providing a low basis for calculating inflation for the same period this year.

From July to December 2012, consumer inflation stayed between 1.8 percent and 2.5 percent, lower than last year's actual inflation rate of 2.6 percent, NBS data shows.

Meanwhile, meat products may enter another rising cycle in the latter half, Wang said.

Liu agreed, saying that demand for meat will get back on track if the H7N9 cases wane, causing possible meat supply shortages and adding to inflationary pressure.

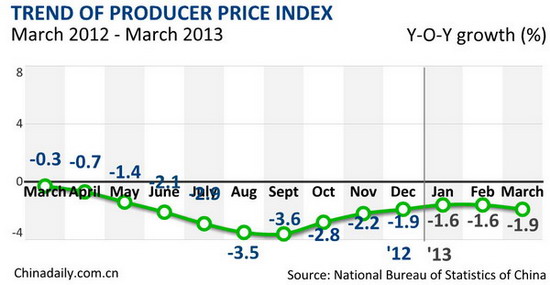

The NBS also said China's producer price index, which measures wholesale inflation, fell for the 13th consecutive month. It dropped 1.9 percent year-on-year, suggesting continued weak market demand.