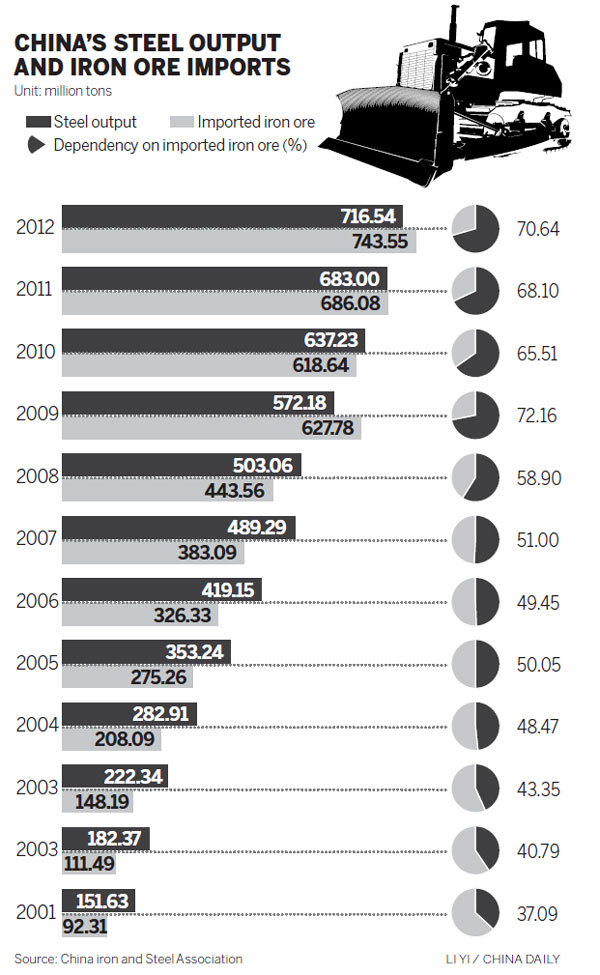

Iron ore producers and traders face a weak market with falling prices, and analysts believe these conditions will persist through the third quarter.

During the first four months of the year, about 2.13 million metric tons of iron ore were unloaded at Qinhuangdao port, a major commodity trading port that is seen as an economic bellwether.

The volume was basically flat compared with the same period of last year, according to General Cargo Branch Co, which handles the port's iron ore business.

The company declined to release more recent data. But visitors to the port can easily see that unloading facilities are idle. And workers have observed a slowdown, too.

A 40-something man who declined to give his name, who said he has worked in the port for six years, noted that iron ore shipments had become irregular, with two or three arrivals spaced over four days or a week.

"In previous months, large volumes were common," he said.

Another male worker at the storage yard said companies have been stockpiling iron ore there for longer periods recently.

"Steel companies are pessimistic about the market outlook, so they have been reducing raw material inventories, mainly iron ore," said Xu Xiangchun, information director of Mysteel.com, a steel industry website and consultancy company based in Shanghai.

"In addition, many steel companies are short of money at present," he said. "Steel companies are trying to improve their cash flow by reducing or even selling iron ore stockpiles."

According to the China Iron and Steel Association, 30 of the country's 86 medium-sized and large steel companies reported losses in the first quarter.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant