Another key financial reform kicked off. This time, in the insurance sector. What will the reform mean for customers and for companies?

The actuarial assumption interest rate will no longer bear the cap of 2.5 percent, as it used to in the past 14 years.

In another way, in the past, if one costumer buys a one-year insurance product with 10 thousand yuan, the maximum estimated profit is 250 yuan. But starting today, since the rate doesn't have to remain under 2.5 percent, people can expect an equal profit with less payment, or the other way around. But all this is going to be decided by insurance companies, and the market.

"The reform of the actuarial assumption interest rate is an important part of China's recent financial reforms. The liberalization of prices in the insurance sector is a very significant move, like liberalizing prices in business market. This will largely boost competition in the insurance market." Zhang Chenghui, director of Research Institute of Finance, Development Center of the State Council said.

China Insurance Regulatory Commission will offer help and administration. In the future, long-term personal insurance will embrace a lower capital requirement on disease, death and accident related products. This is estimated to release about 20 billion yuan capital for insurance companies to expand their services.

"Along with the competition, service qualities will improve. Consumers will enjoy more insurances in terms of endowment insurance or health insurance. In the mid-long term, consumers will spend more money, which boosts the consumption and country's economic development." Zhang Chenghui said.

All things are difficult before they are easy. The reform will surely give insurance companies a hard time at the beginning, as it puts fierce competitions in the business. But in the long term, let's wait and see.

Since the reform aims to boost competition, the insurance companies face a new set of challenges, to survive.. But how's this going to affect the whole insurance business? Let's take a listen to what the experts predict.

"In the short term, competitions will bring more benefits. It tests the pricing mechanism, profitability and risk control of insurance companies. As the prices are liberalized, competitions will be much more fierce than before. This will also affect the profit and compensation ability." Zhang Chenghui said.

"Insurance companies can give different services according to their own abilities and customers' demands. This will expand the insurance business and accelerate its development." Li Xiaolin, Member of Insurance Institute of China said.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

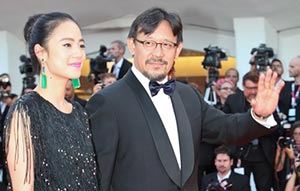

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant