Strong rebound suggests second-largest economy is stabilizing, analysts say

Global investors got a sigh of relief on Thursday, as China's better-than-expected trade growth appeared to suggest world demand is recovering.

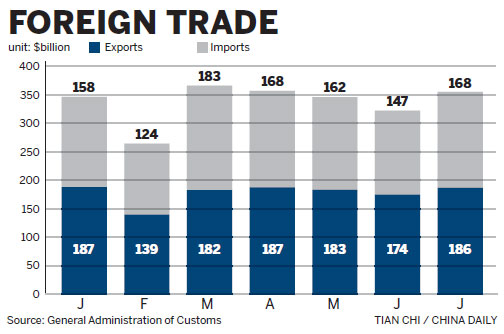

China's exports in July rose 5.1 percent year-on-year after sliding 3.1 percent in June, the General Administration of Customs said. Imports surged 10.9 percent, compared with the 0.7 percent decline in June.

"The July figures are satisfactory," said Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a government think tank.

"Exports returned to the normal growth track and the sharp rebound of imports signals the easing of downward pressure on the Chinese economy," Huo said.

Global stock markets responded positively to China's data as shares jumped in Sydney, Seoul, Hong Kong and European cities on Thursday.

The Chinese economy recorded its worst performance in 13 years in 2012, with GDP expanding 7.8 percent. Growth dipped to 7.7 percent in the January-March period and slowed further to 7.5 percent in the second quarter.

The July trade figures soothed worries that China's economy may experience a hard landing.

Chen Hufei, a researcher at Bank of Communications, said the improvement in exports came after a recovery in demand for Chinese goods, although the recovery is not solid.

China's shipments to the United States and the European Union, its top two markets, increased in July for the first time in five months.

July exports to the US climbed 5.27 percent year-on-year and those to the EU gained 5.87 percent.

Jean-Paul Larcon, a professor of strategy and international business at HEC Paris, said the recovery in China's exports to the EU was "because Europe is gradually recovering and European enterprises are starting to import more from China and the rest of the world".

"I am optimistic about the future trade prospects," Larcon said. "The economic recovery is on track (in the EU). The trade data is a good sign that we are going out of the bottom of the crisis. So in the next six months, the situation could be better and major economic indicators could be back to the normal level."

China's exports are shifting to a moderate rate of growth from the double-digit expansion of past years, but economic transformation and restructuring helped exporters retain their markets, Huo said.

Huo expressed confidence that the country can achieve its 8 percent trade growth target for the year.

Wu Shengneng, a senior manager at Kangnai Group, a leading shoemaker in China, said the company introduced personal design services to customers this year to meet the rising demand from high-end buyers who are looking for uniqueness.

The company is expecting 15 to 17 percent annual growth on sales by manufacturing shoes to regular overseas clients at an average price of $60 to $70 per pair, while most Chinese shoemakers only sell products at $30.

Kangnai has more than 100 stores in France, Italy and some South Asian countries and makes shoes for several well-known brands in the world.

Late last month, the central government rolled out measures to boost trade, such as simplification of customs clearance, reduction of administrative fees and more financial aid.

Wang Jin, an analyst at Guotai Junan Securities, said the improvement of imports in July suggested a recovery of domestic demand.

To keep GDP growth within reasonable limits, the State Council, led by Premier Li Keqiang, introduced supportive measures at the end of July for economic growth, including increasing investment of railway and urban infrastructure construction and stimulating information consumption, which helped increase domestic demand.

China also imported more materials last month, reflecting rising demand from manufacturing businesses.

Iron ore imports to China, the world's biggest buyer of the raw material, rose 26.7 percent to 73.14 million metric tons in July as falling prices spurred mills to stock up.

Last month, China was also the world's second-biggest oil consumer, and increased net crude imports to a record high 25.9 million metric tons, or 6.13 million barrels a day.

Bloomberg contributed to this story.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant