A recent study by the Boston Consulting Group indicates Chinese consumers were prepared to pay a 30 percent higher premium price for iPhones despite their incomes being much lower than that of US consumers.

John Ross, visiting professor at Antai College of Economics and Management of Shanghai Jiao Tong University and a former policy adviser to ex-London mayor Ken Livingstone, said this does not accurately reflect the realities of the market since Apple only has a 7.5 percent share of the Chinese smartphone market.

"Even Samsung, which has been the market leader, is losing share. It is cheaper Chinese brand smartphones such as Lenovo, Coolpad and Huawei which are the big gainers," he said.

"This shows the extreme sensitivity of China's consumers to price," he said.

Ross said there are many difficulties in trying to assess whether people are middle class in China by the consumer choices they make.

"In the US or Europe, McDonald's or KFC, for example, would be considered very cheap and available even to those with very low incomes," he said.

"In China these are relatively higher priced, not bottom of the price range, items. This is why, for example, a KFC restaurant in China has far more 'eat in' tables than a KFC in the US or Europe."

Martin Jacques, author of When China Rules the World: The Rise of the Middle Kingdom and the End of the Western World, believes attempts to define the middle class in China can be hopelessly vague.

"We have got to remember the middle class is a pretty nebulous category. What essentially is the middle class in China and the developing world? Is it really just the new urban classes who have got a bit of money they didn't have before. It is essentially an urban concept."

Live streaming boosts zongzi sales

Live streaming boosts zongzi sales

Big Data Expo opens

Big Data Expo opens

Smart sharing washing machines available in Shanghai

Smart sharing washing machines available in Shanghai

Innovative designs highlight industrial design week

Innovative designs highlight industrial design week

Smart tech to shake up delivery industry

Smart tech to shake up delivery industry

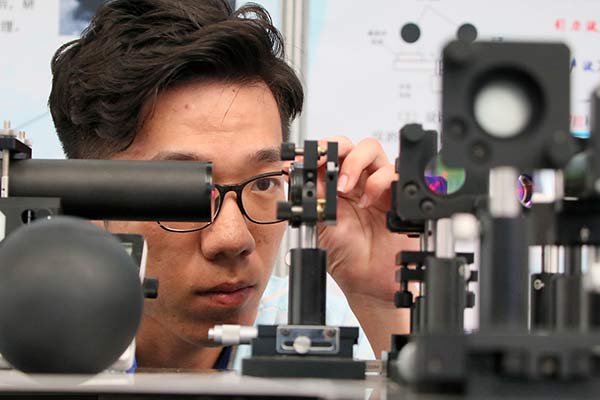

Chinese youths showcase innovative talents at tech competition

Chinese youths showcase innovative talents at tech competition

Butterfly wings to inspire new solar power technology

Butterfly wings to inspire new solar power technology

Singapore dealership sells luxury cars in 15-floor vending machine

Singapore dealership sells luxury cars in 15-floor vending machine