PMI falls to lowest level since Aug

By CHEN JIA in Beijing and YU RAN in Shanghai (China Daily) Updated: 2014-01-02 01:00Weakening growth blamed on caution, moderate demand

|

|

|

A worker checks spindles at Jiujiang Xinxing Fiberglass Co Ltd in Jiujiang, Jiangxi province, on Wednesday. The index of new export orders for manufactured products fell to 49.8 in December from 50.6 in November. LIU HAIYAN / FOR CHINA DAILY |

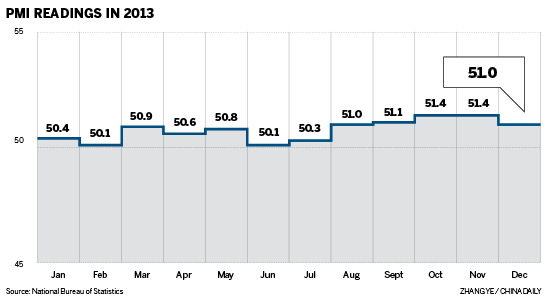

The December manufacturing Purchasing Managers' Index retreated to 51 from 51.4 in November, the lowest level since August, indicating weaker economic growth momentum amid moderate external demand and entrepreneurs' cautious expectations.

The National Bureau of Statistics and China Federation of Logistics and Purchasing jointly released the December manufacturing PMI on Wednesday.

New export orders for manufacturing products showed a contraction for the first time in five months, according to a PMI sub-index of 49.8 in December, compared with 50.6 in November.

The growth of new orders slowed slightly to 52 from 52.3 from a month earlier.

Another sub-index showing entrepreneurs' production expectations for the coming months dropping to 49.4 from 54.9 over a month suggests that, to some extent, economists are worried about the future macroeconomic environment.

In addition, the sub-index of production output fell to 53.9 in December, down from 54.5 in November, the first drop in the second half of 2013. The iron, steel, nonferrous metals and non-metallic mineral products industries showed sharper production slowdowns.

For the indexes, any reading above 50 means an improving situation from a month earlier, but a figure below 50 means deterioration.

Zhao Qinghe, an economist from the statistics bureau, said the weaker momentum indicated by December's PMI is mainly due to seasonal factors.

"However, the PMI figure still shows expansion in December. Furthermore, it has remained above 50 for 15 consecutive months, which means the general industrial situation is stable," said Zhao.

Chen Zhongtao, an analyst from the China Federation of Logistics and Purchasing, said during the process of accelerating structural rebalancing and controlling overcapacity, the growth rate of manufacturing industries may continue to slow.

"A key task for 2014 macroeconomic policies is to expand domestic demand in order to stabilize the overall economic growth, as well as to be careful about a possible sharp contraction of exports because the international environment is complicated," said Chen.

Zhang Rui, the owner of Chuangsi Optical Spectacles Co Ltd in Wenzhou, Zhejiang province, said: "There was a slight growth in the number of orders from overseas for Christmas and the New Year from August to October. The off-peak season for export trading arrived in November with quite substantial incoming demand."

His company aimed to achieve a 20 percent growth rate in profit for 2013 but managed to obtain about 10 percent because overall exports remained sluggish over the past year.

Ye Mingchun, the manager of Zhejiang Tianyiqi Shoes Co Ltd, based in Taizhou, Zhejiang province, said: "There was no obvious sign a recovery had arrived with a great number of orders for 2014, but the situation seemed to be improving with more new clients sending e-mails about requirements for products from December."

He added that most manufacturing enterprises are trying to make a comeback by upgrading their designs and quality in order to gear the market toward high-end customers.

Some economists warned that compared with large companies, small producers face a tough road.

According to official data, the PMI for small companies dropped to 47.7 in December, compared with 48.3 in November, indicating a production contraction. The figure for medium-sized companies fell to 49.9 from 50.2.

Meanwhile, large factories' PMI was 52 in December, lower than its figure of 52.4 in November.

Supportive measures are needed to sustain the growth of small businesses, which can strengthen entrepreneurs' confidence, said Chen from the China Federation of Logistics and Purchasing.

Lian Ping, chief economist at the Bank of Communications Co Ltd, said small businesses will face much bigger operational pressures when exchange rate fluctuations occur if the United States decides to end its quantitative easing policy.

"Rising domestic loan interest rates will also increase capital costs of producers," Lian said. "Therefore, further tax cuts for small companies are necessary in 2014."

Contact the writers at chenjia1@chinadaily.com.cn and yuran@chinadaily.com.cn

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday