Lenovo to buy IBM server unit

By Gao Yuan (China Daily) Updated: 2014-01-24 09:32

Lenovo took about five years to bring its PC sector back on track after it acquired IBM's PC unit in 2005 for $1.25 billion.

Gene Cao, senior analyst at Forrester Research Inc, warned that Lenovo should learn some lessons from the previous buyout of IBM's PC business.

"The company should find ways to keep the R&D team at the unit and better integrate sales channels," said Cao.

Yang said that integrating new units of this size will not be a problem for Lenovo, because the company is strong and flexible enough to quickly merge new units into its global structure.

The deal is expected to be completed in the next few months after passing a regulatory review process in the United States.

"This new IBM-Lenovo deal may potentially receive more attention from US authorities than the PC business acquisition years ago," said Cao.

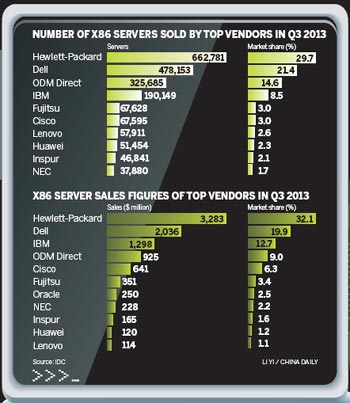

Many x86 servers are used in key areas in the US, including government, telecommunications and financial system offices.

The US government is known to be sensitive when it comes to Chinese M&A deals in the IT sector.

In 2011, Chinese company Huawei Technologies Co Ltd's attempt to acquire US-based 3Leaf Systems Inc was blocked by the US government, which cited security concerns.

Lenovo will fully cooperate with the US government's review process, Yang said.

Lenovo is vigorously exploring both the consumer electronics and enterprise equipment markets amid the slump in the global PC market.

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday