Shadow banking can have good ending

By Wu Jiangang (China Daily) Updated: 2014-02-17 07:23Although the Chinese shadow banking system is renowned for its opacity, the latest annual financial market report by the Chinese Academy of Social Sciences estimates the system had 20.5 trillion yuan ($3.3 trillion) in total assets - roughly 40 percent of China's GDP - in 2013.

As China is now the second-largest economy in the world, we need to examine the nature and risks in the shadow banking sector.

China's growth model has worked well for the last 30 years in terms of GDP growth, which is supported by government investment and exports. The funds for government investment were generated because of low expenditure on social welfare, high taxes and financial-sector monopoly. Exports rose because of low wages and generous incentives but at the expense of the environment.

But this growth model is becoming more and more unsustainable at a time when wages keep rising, real estate prices keep going up, pollution becomes more severe, the monopolistic finance sector becomes more and more unfeasible and government investments become more inefficient.

The turning point for China was 2008, when the export sector was hit by weak external demand caused by the subprime mortgage crisis. To prevent large-scale unemployment and potential social instability, the central government approved about 4 trillion yuan for infrastructure projects and mobilized the State-owned banking system to provide loans.

Lending leapt from 3.6 trillion yuan in 2007 to 9.6 trillion yuan in 2009. In addition, these projects needed subsequent funding.

Before 2008, the vast majority of lending in China was carried out by regular banking. But after 2008, as policymakers began to worry about the credit boom, inflation, a property bubble and overcapacity, they attempted to put the brakes on. The regulator imposed severe requirements on commercial banks in the form of deposit reserve requirements, loan ratios and capital adequacy ratios.

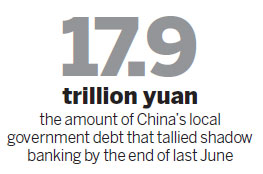

As the projects that had already started needed further funding and local governments secured loans implicitly guaranteed by the central government, commercial banks used many financial tools or innovations that are now classified as shadow banking to provide unregulated loans.

The main tools or innovations are wealth management products, loans through trust companies, entrusted loans, inter-bank repurchase agreements and bank guarantees. According to official statistics, wealth management products were worth only 530 billion yuan in 2007, but soared to 1.7 trillion yuan by the end of 2009 and 9.9 trillion yuan by the end of September of 2013. Total lending through trust companies was 340 billion yuan in 2007, rising to 680 billion yuan in 2009 and 2.6 trillion yuan in 2013. Total entrusted loans were 170 billion yuan in 2007 and grew to 440 billion yuan in 2009 and 1.8 trillion yuan in 2013.

|

|

|

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday