Analyzing Premier Li's work report

By Wang Qingfeng (chinadaily.com.cn) Updated: 2014-03-06 10:40

|

|

|

|

Air pollution was one of the hottest topics in Chinese media coverage in 2013. It is also a key concern for millions in China. In many cities in China, air pollution readings often go above the safety limits recommended by the World Health Organization. In his speech, Premier Li reiterated that the government will act on curbing air pollution. His ultimate goal is to transform the country into a beautiful homeland with a sound ecological environment.

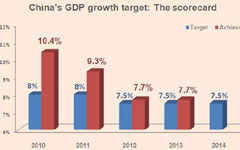

China is undergoing political, economical and financial reforms. China is also facing unprecedented opportunities and challenges. China will enjoy the opportunities of even higher economic growth for some time to come as the country is getting ready for further industrialization and urbanization, and there is considerable potential for regional development as stated in Premier Li's speech. China is bracing itself to take the challenges of downward pressure on economy from the reforms and from the global financial uncertainty, in addition to the challenges from a changing world political landscape.

The author is with the Nottingham University Business School China

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday