Developers discover room for growth overseas

By Hu Yuanyuan (China Daily) Updated: 2014-03-18 07:34Cross-border real estate developments are a growing phenomenon in Asia, according to Nicholas Holt, Knight Frank's head of Asia-Pacific research.

|

|

|

|

In 2013, more than 76 percent of total inbound capital into the development markets of the United Kingdom, the United States and Australia originated from China, Singapore, Malaysia and India, according to Knight Frank.

"Brand building, diversification, growth and selling back to domestic buyers have been key drivers," said Holt from Knight Frank.

He said London, New York, Hong Kong, Singapore, Paris and Sydney will continue to be targeted by developers.

"Investors from China will increasingly recognize homegrown brands when they buy luxury developments in London, New York, Sydney and Vancouver," he added.

As to what guides an investor in buying overseas property, education remains a key driver in terms of prime residential developments. That may eventually be true as well of commercial property acquisitions, he said.

According to Knight Frank's research, about 50 percent of ultra-high-net-worth individuals are likely to send their children overseas for higher education. The US, UK and Australia are the top three destinations for those families.

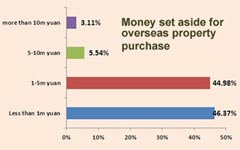

Meanwhile, more middle-class households are making overseas home purchases for investment purposes, as they react to continually rising prices and tightening measures in the domestic market.

Louis Bai, chief executive officer of the Beijing branch of Barratt Homes Plc (a UK-based developer), said members of China's emerging middle class, not millionaires, have been the major buyers of the company's projects in London this year.

"Most of our individual buyers' annual household incomes hover around 500,000 yuan. About 60 percent of them are pure financial investors, while 40 percent are thinking about emigration and children's education," Bai said.

Diversifying their investment portfolio is a key motivation in buying overseas property, he added.

|

|

|

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday