Repayment pressure rising, along with bankruptcy concerns

By Xie Yu (China Daily) Updated: 2014-03-19 07:38A similar product created by Jilin Province Trust Co has missed five payments worth 872 million yuan.

"We believe that the high level of leverage in the economy, combined with slowing growth and rising interest rates, implies rising default risks," said Dariusz Kowalczyk, a strategist at Credit Agricole CIB. "We expect defaults of other corporate bonds and trust products as well as one or two bankruptcies of small local banks this year."

Several reports noted that China faces unprecedented repayment pressure: a total 5.3 trillion yuan of trust loans to mature this year, 50 percent up year-on-year, according to Haitong Securities Co Ltd.

Local government financing vehicles (set up to meet local government financing needs for mainly infrastructure projects) need to repay about 82.5 billion yuan by the end of April, 37 percent of this year's 224.84 billion yuan total, according to data from China Chengxin International Credit Rating Co, Moody's Investors Service's joint venture in China.

Moreover, 945 listed medium-sized and large non-financial companies showed total debt soared more than 260 percent to 4.74 trillion yuan between December 2008 and September 2013, a Thomson Reuters' calculation said.

Many overseas analysts said China's economic growth is increasingly credit-consuming.

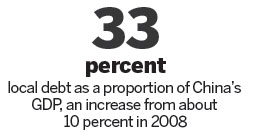

The past six to seven years have seen economic growth and credit dynamics on crossed trajectories. Growth decelerated from about 11 percent 12 percent in 2006-07 to 7 percent 8 percent now while an increase in social financing gained momentum.

"In any economy in the world, this situation would lead to deterioration in payment behavior. China should be no exception," a report by Credit Agricole CIB said. Several default cases have triggered concerns about the Chinese market in recent months. "Major risks stem from real estate and other industries with excess capacity like mining and metallurgy. Trust projects financing the property industry are suffering from very tight cash flow this year, and some are very likely to default," Lin Caiyi, chief economist with Guotai Junan Securities Co Ltd wrote in a recent report.

|

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday