Policy measures to bolster share prices

By Xie Yu in Shanghai (China Daily) Updated: 2014-07-02 07:11Listed companies anticipate better conditions for liquidity during the second half

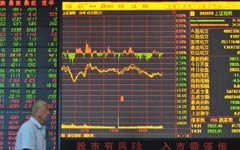

Looser policies designed to stabilize the macroeconomy will help fuel a recovery in share prices during the second half of the year and bolster sagging capital market sentiment, analysts said on Tuesday.

|

|

|

"The economic growth in the first six months has been below expectations, and we believe the authorities will take more mini-stimulus measures during the second half of the year to achieve the full-year GDP growth target of 7.5 percent," said Yang Delong, chief strategist with China Southern Asset Management.

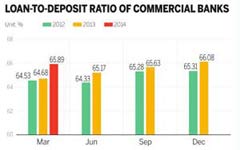

Chinese banks were permitted to remove three types of loans from scrutiny on Tuesday, including funds lent under the central bank's re-lending facility to support small enterprises, and commercial bank loans from international financial institutions or foreign governments. The announcement by the China Banking Regulatory Commission is seen as a step that will boost lending and inject liquidity in the interbank market.

"It is highly likely that liquidity conditions will improve in the second half of the year," a report issued recently by China International Capital Corp said. The institution maintained the target of gains up to 20 percent for A shares in 2014, with large-company shares outperforming small caps.

The report said although initial public offerings will impede market performance, ongoing reforms will improve prospects for sustained middle- and long-term growth.

- US sets preliminary subsidy rates on China's steel wire rod

- New flight connects Xi'an, Moscow

- Xbox One readies for national debut

- Restrictions loosened in Shanghai trade zone

- Highlights at 2014 Shenyang auto show

- June PMIs in positive territory

- Exotic locations lure the nation's wealthy tourists

- Housing prices drop for second consecutive month