China's impact beyond commodities

By Wang Tao (chinadaily.com.cn) Updated: 2014-07-02 13:35Since 2003, Europe has made the greatest inroads into China's chemicals, machinery and transport equipment import markets, dominating them all in 2013. Some of the gains seem to have come at Japan's expense, especially in recent years. This increased exposure to China also implies increased vulnerabilities to a China slowdown. Also, the US and Japan seem to have made a comeback of late.

China's importance for global growth has risen incredibly over the past decade not only for emerging but also developed markets. In the 2014 edition of our annual China export exposure chart book, we look at how China's importance as an export market has evolved over the past decade. We note that the importance of China as an ultimate "consumer" of imports has gone beyond commodities.

Consequently, a serious slowdown in Chinese domestic demand will have implications far beyond commodities and commodity exporters alone. A recent study by our European industrial sector analysts suggests that China has underpinned more than a third of the European industrial sector's profit growth since 2003.

As an export market, China’s importance has more than doubled for over a quarter of its key trading partners. Countries that have gained the most in terms of exposure to China include the usual commodity exporters such as Australia and South Africa (more than quadrupled), and Canada, Brazil and Chile (more than doubled or tripled). China's importance for the US, Europe and Japan has also increased notably, but by less than the commodity exporters.

The country’s rise in importance as a commodity importer was not only due to its construction boom, but also its capacity expansion in the metals and equipment industries. There is no doubt that China's property and construction boom since the turn of this century has fuelled a rapid increase in its appetite for base metals and energy imports, boosted further by the government's massive infrastructure-focused stimulus plan following the global financial crisis.

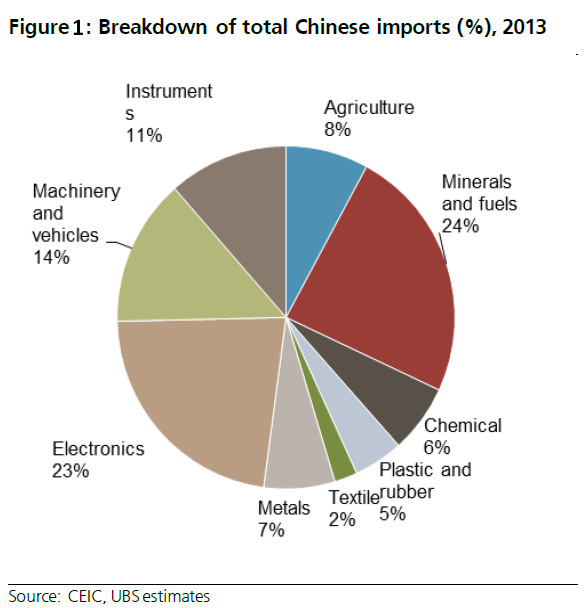

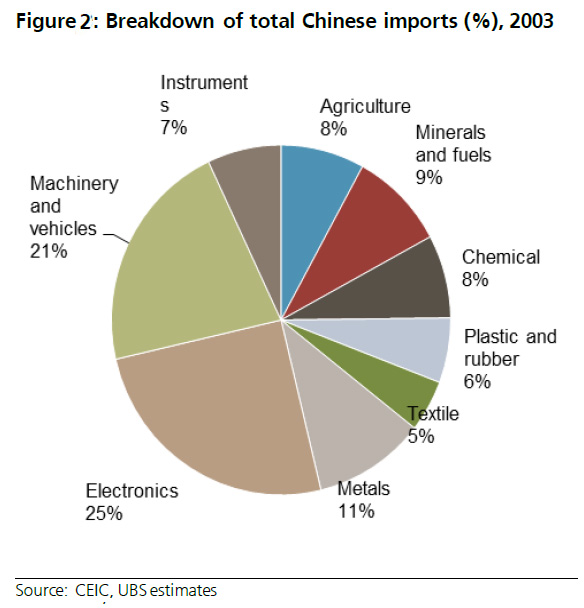

However, at the same time, China's investment in its domestic metals and machinery industries has also grown rapidly, leading to a significant expansion of its industrial capacity and production capabilities in metals and machinery. As China manufactured more and more of its own metals and machineries, the share of intermediate products and capital goods in its total imports fell over the past decade.

In contrast, the share of minerals and fuels in its total imports rose from 9 percent in 2003 to 24 percent in 2013. More specifically, the share of metal imports (e.g. steel) dropped from 11 percent in 2003 to 7 percent in 2013, the share of machinery and vehicles imports declined from 21 percent to 14 percent, as the share of chemicals and textiles imports similarly fell over the same period. Indeed, China's trade balance in machinery and equipment reversed from a substantial deficit before 2007 to remain largely in surplus thereafter.

- Chinese vehicle brands welcomed in Kenya

- 99 Chinese companies raise $18b through IPOs

- Transformers dominates China box office

- China's impact beyond commodities

- Mauritius and China Southern Airlines sign partnership agreement

- M&M opens its first Asia flagship store in Shanghai

- Auto manufacturing plants to disappear in Australia

- Hyundai Motor set to expand production at Brazil plant