Slack property market takes toll on services

By ZHENG YANGPENG (China Daily) Updated: 2014-08-06 07:14

|

|

|

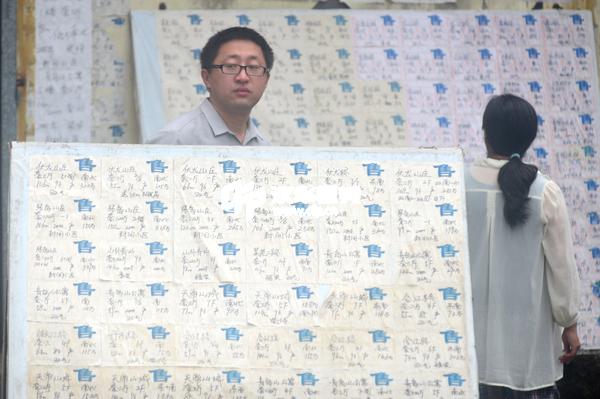

A housing brokerage promotes secondhand homes for sale in Qingdao, Shandong province. Experts said the nation's sagging property market was one of the main reasons behind the weakening non-manufacturing PMI data. [Photo/China Daily] |

Main HSBC performance index for July ebbs to lowest point in 9 years

China's weakening property market took its toll on the nation's service sector, as a private gauge of service activity sank to a nine-year low.

The Purchasing Managers Index for the service sector, jointly released by HSBC Holdings Plc and Markit Ltd on Tuesday, fell to 50 in July from 53.1 in June, the lowest reading since November 2005 when the survey began.

The figure indicated a stagnation of service activity last month. A reading above 50 indicates an expansion in activity while one below points to a contraction.

"The weakness in the headline number likely reflects the impact of the ongoing property slowdown in many cities as property-related activity, such as agencies and residential services, saw less business," said HSBC's China chief economist Qu Hongbin.

"The data point to the need for continued policy support to offset the drag from the property correction and consolidate economic recovery," Qu said.

The real estate sector accounted for 15 percent of GDP in 2012, according to an International Monetary Fund estimate. The property sector affects manufacturing industries such as cement and steel, as well as service industries such as real estate agents, interior furnishing and banking.

The IMF has warned that the correction in the property industry could depress GDP growth by a full percentage point.

Home prices dropped for the third consecutive month in July, according to a survey of 100 major cities released by the China Real Estate Index System, a property market data provider. Among the 100 cities, 76 recorded price declines and 24 had increases, despite the fact that 60 percent of the 46 cities that had property curbs had eased them to boost demand.

Liu Xuezhi, a researcher with Bank of Communications Ltd, agreed that the sagging property market was the chief reason behind the weakening PMI data.

"Exacerbated by lower credit support from the banks, China's property market began a serious correction in the second quarter. Now, the impact on many related businesses has started to become apparent," he said.

|

|

|

| East China city lifts home purchase limit | Housing market faces price corrections, says think tank |

- Sri Lankan calls on firms to ready for China FTA

- Beijing's office rent set to stabilize in H2

- China-style investment policy might resolve land sale row

- Two Chinese firms plan to list on Seoul bourse

- China to punish Chrysler, Audi for anti-trust violations

- China's antitrust body slaps fine on Japanese firms

- Paring off time

- Chinese solar company launches plant in S. Africa